What is RBI Bonds (Floating Rate Savings Bonds)?

RBI Bonds (Floating Rate Savings Bonds) are government securities issued by the Reserve Bank of India (RBI) on behalf of the Government of India. These bonds offer a floating interest rate which is reset periodically based on a benchmark (typically linked to the government securities yield). They are designed to provide investors with protection against interest rate fluctuations.

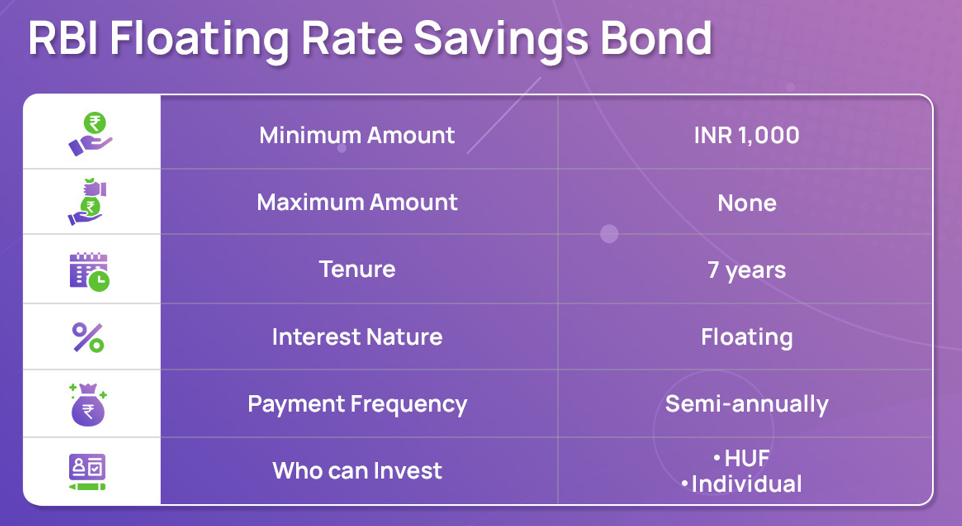

- Issuer: Reserve Bank of India (RBI)

- Interest: Floating rate (reset every 6 months)

- Tenure: Typically 7 years

- Purpose: Safe investment backed by the Government of India with returns linked to market interest rates.

Benefits of RBI Bonds (Floating Rate Savings Bonds)

| Benefit | Explanation |

|---|---|

| Safety | Backed by Government of India, almost risk-free in terms of default |

| Floating Interest Rate | Interest rate resets every 6 months, protecting investors against rising interest rates |

| Tax Benefits | Interest is taxable, but no TDS is deducted |

| Liquidity | Tradable on stock exchanges (with some conditions) |

| Non-Callable | Cannot be redeemed before maturity, ensuring fixed tenure |

| No Market Risk on Principal | Principal is guaranteed, no risk of capital loss if held to maturity |

Risks of RBI Bonds (Floating Rate Savings Bonds)

| Risk | Explanation |

|---|---|

| Interest Rate Risk | Though floating rate mitigates this, if benchmark falls, returns decline |

| Taxation on Interest | Interest income is taxable as per your income tax slab |

| Liquidity Risk | Though tradable, secondary market may have low liquidity |

| No Early Redemption | Investors can’t redeem before maturity, reducing flexibility |

| Inflation Risk | If inflation exceeds bond yield, real returns could be negative |

Top RBI Floating Rate Saving Bonds Plans in India

Note: RBI issues these bonds in different tranches/series, usually differing slightly in interest rates and issuance dates. Here are some recent/major ones.

| Plan Name | Issue Date | Tenure | Interest Rate (Floating) | Special Features |

|---|---|---|---|---|

| RBI Floating Rate Savings Bonds 2020 Series A | Aug 2020 | 7 years | 7.15% p.a. (reset every 6 months) | Tradable on exchanges |

| RBI Floating Rate Savings Bonds 2019 Series A | Sep 2019 | 7 years | 7.25% p.a. (reset every 6 months) | Tax benefits, no TDS |

| RBI Floating Rate Savings Bonds 2018 Series A | Nov 2018 | 7 years | 7.10% p.a. (reset every 6 months) | Government-backed safety |

| RBI Floating Rate Savings Bonds 2017 Series A | Oct 2017 | 7 years | 7.20% p.a. (reset every 6 months) | Floating rate linked to G-sec yield |

| RBI Floating Rate Savings Bonds 2016 Series A | July 2016 | 7 years | 7.30% p.a. (reset every 6 months) | No TDS deducted |

| RBI Floating Rate Savings Bonds 2015 Series A | Aug 2015 | 7 years | 7.35% p.a. (reset every 6 months) | Tradable on NSE/BSE |

| RBI Floating Rate Savings Bonds 2014 Series A | Sep 2014 | 7 years | 7.25% p.a. (reset every 6 months) | Safe government-backed |

| RBI Floating Rate Savings Bonds 2013 Series A | Oct 2013 | 7 years | 7.40% p.a. (reset every 6 months) | Semi-annual interest payment |

| RBI Floating Rate Savings Bonds 2012 Series A | Nov 2012 | 7 years | 7.50% p.a. (reset every 6 months) | Principal protection |

| RBI Floating Rate Savings Bonds 2011 Series A | Dec 2011 | 7 years | 7.60% p.a. (reset every 6 months) | Government guarantee |

Comparison Table: RBI Floating Rate Saving Bonds Plans

| Plan Name | Issue Date | Interest Rate (Initial) | Tradability | Tax on Interest | Liquidity | Pros | Cons |

|---|---|---|---|---|---|---|---|

| 2020 Series A | Aug 2020 | 7.15% | Yes (Stock Exchange) | Taxable (No TDS) | Moderate (Tradable) | Govt backed, floating rate, tradable | No early redemption |

| 2019 Series A | Sep 2019 | 7.25% | Yes | Taxable (No TDS) | Moderate | Slightly higher initial rate | Locked for 7 years |

| 2018 Series A | Nov 2018 | 7.10% | Yes | Taxable (No TDS) | Moderate | Safe, floating rate | Interest taxable |

| 2017 Series A | Oct 2017 | 7.20% | Yes | Taxable | Moderate | Government backed, floating interest | Illiquid if sold prematurely |

| 2016 Series A | July 2016 | 7.30% | Yes | Taxable | Moderate | No TDS, floating interest | No early redemption |

| 2015 Series A | Aug 2015 | 7.35% | Yes | Taxable | Moderate | Tradable, govt guarantee | Long lock-in period |

| 2014 Series A | Sep 2014 | 7.25% | Yes | Taxable | Moderate | Govt backed, floating rate | Interest taxed |

| 2013 Series A | Oct 2013 | 7.40% | Yes | Taxable | Moderate | Semi-annual interest payments | Market rate dependent |

| 2012 Series A | Nov 2012 | 7.50% | Yes | Taxable | Moderate | Principal protection, floating rate | No early withdrawal |

| 2011 Series A | Dec 2011 | 7.60% | Yes | Taxable | Moderate | Govt guaranteed, semi-annual interest | Interest income taxed |

Frequently Asked Questions (FAQs) on RBI Floating Rate Savings Bonds

- Who can invest in RBI Floating Rate Savings Bonds?

Resident Indian individuals including minors and HUFs. - What is the tenure of these bonds?

Typically 7 years. - How is the interest rate determined?

The interest rate is floating and reset every 6 months based on the prevailing government security yields. - Is the principal amount guaranteed?

Yes, principal is guaranteed by the Government of India. - Are these bonds tradable?

Yes, they are listed and can be traded on NSE/BSE. - Is there a lock-in period?

Yes, bonds cannot be redeemed before maturity (7 years). - Are the interest payments taxable?

Yes, interest income is taxable as per the investor’s income tax slab. - Is TDS deducted on interest?

No, no tax deduction at source is applicable. - Can NRIs invest in these bonds?

No, these bonds are generally meant for resident Indians only. - How to apply for these bonds?

Through designated banks, post offices, or online platforms during the bond issuance period.