What is Senior Citizens’ Savings Scheme (SCSS)?

Senior Citizens’ Savings Scheme (SCSS) is a government-backed savings program in India designed specifically for senior citizens aged 60 years and above (and for certain retired individuals aged 55-60). It offers a safe and secure way to invest money with attractive interest rates and regular income through quarterly interest payments. The scheme aims to provide financial security and steady returns to retirees and senior citizens, helping them manage their post-retirement expenses with ease. Investments in SCSS are eligible for tax benefits under Section 80C of the Income Tax Act.

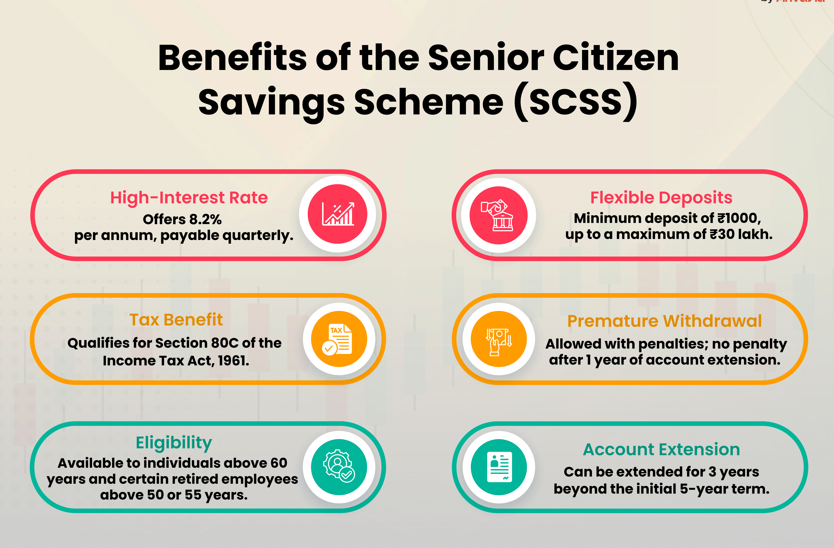

Benefits of Senior Citizens’ Savings Scheme (SCSS)

The benefits of the Senior Citizens’ Savings Scheme (SCSS) include:

- Safety: It is backed by the Government of India, making it one of the safest investment options for senior citizens.

- Attractive Interest Rate: SCSS offers a higher interest rate compared to many other fixed-income investments, providing better returns.

- Regular Income: Interest is paid out quarterly, giving senior citizens a steady and predictable source of income.

- Tax Benefits: Investments up to ₹1.5 lakh qualify for tax deductions under Section 80C of the Income Tax Act.

- Long Tenure with Extension: The scheme has a tenure of 5 years, which can be extended by an additional 3 years for continued benefits.

- Flexible Investment Amount: Minimum investment starts at ₹1,000, making it accessible, with a maximum limit of ₹15 lakh.

- Premature Withdrawal: Allowed after 1 year with a small penalty, offering some liquidity in emergencies.

- Joint Account Facility: Senior citizens can open accounts jointly with their spouses, offering additional flexibility.

- Simple to Open and Manage: Available at post offices and authorized banks, making it easy to access and maintain.

Risks of Senior Citizens’ Savings Scheme (SCSS)

Here are the risks of the Senior Citizens’ Savings Scheme (SCSS):

- Interest Rate Risk: The interest rate is fixed at the time of investment but may become less attractive if market rates rise later, potentially leading to lower returns compared to newer schemes.

- Inflation Risk: Returns may not always keep pace with inflation, which can reduce the real value of the income over time.

- Premature Withdrawal Penalty: If you withdraw before completing one year or before maturity, a penalty is imposed, which reduces overall returns.

- Tax on Interest Income: The interest earned is fully taxable according to your income tax slab, which can reduce net returns.

- Lock-in Period: The initial 5-year tenure means funds are locked in, reducing liquidity and flexibility.

- Maximum Investment Limit: The scheme caps investment at ₹15 lakh, which may limit the scale of returns for those with larger amounts to invest.

- No Capital Appreciation: SCSS offers fixed returns with no potential for capital growth, unlike equity-linked or market-linked instruments.

Top 10 Investment Plans for Senior Citizens in India (including SCSS)

| Plan Name | Type | Interest Rate (Approx.) | Tenure | Tax Benefit | Liquidity | Pros | Cons |

|---|---|---|---|---|---|---|---|

| Senior Citizens’ Savings Scheme (SCSS) | Government Scheme | 8.2% p.a. (quarterly) | 5 years (extendable) | Yes (Section 80C) | Premature withdrawal with penalty after 1 year | Safe, regular income, tax benefit | Lock-in period, taxable interest, penalty on early withdrawal |

| Post Office Monthly Income Scheme (POMIS) | Government Scheme | 7.1% p.a. (monthly) | 5 years | No | Premature withdrawal penalty | Monthly income, safe | No tax benefit, interest rate lower than SCSS |

| Fixed Deposits (Senior Citizens) | Bank Deposits | 7.0-7.5% p.a. | 1-10 years | No | Premature withdrawal allowed | Flexible tenure, higher rates | Interest taxable, less flexibility on premature withdrawal |

| Pradhan Mantri Vaya Vandana Yojana (PMVVY) | Government Pension Scheme | 7.4% p.a. (monthly) | 10 years | No | No premature withdrawal | Guaranteed pension, tax-free | No premature withdrawal, less flexible |

| Monthly Income Scheme (MIS) | Post Office | 7.1% p.a. (monthly) | 5 years | No | Premature withdrawal with penalty | Monthly income, safe | No tax benefit |

| Mutual Funds – Senior Citizens Plans | Market-linked | Variable | No fixed | Depends | High liquidity | Potential for higher returns, tax benefits | Market risk, not guaranteed |

| Senior Citizen Savings Bonds | Government Bonds | Varies | 7-10 years | No | Limited liquidity | Tax exemption on interest | Long lock-in, limited availability |

| Atal Pension Yojana (APY) | Pension Scheme | Market-linked returns | Till 60 years | No | Partial withdrawal options | Pension income on retirement | Low returns if invested late |

| Kisan Vikas Patra (KVP) | Government Scheme | 7.1% (doubles in 124 months) | 124 months | No | No premature withdrawal | Doubles investment, government-backed | Long maturity, no regular income |

| Life Insurance Policies (Annuity) | Insurance | Varies | Varies | Yes | Depends on policy | Regular income, tax benefits | Premium cost, lower liquidity |

FAQs for Senior Citizens’ Savings Scheme (SCSS)

Here are some Frequently Asked Questions (FAQs) about the Senior Citizens’ Savings Scheme (SCSS):

- Who is eligible to open an SCSS account?

Indian residents aged 60 years and above. Individuals aged 55-60 who have retired under certain conditions can also apply. - What is the minimum and maximum investment amount in SCSS?

Minimum investment is ₹1,000 and the maximum limit is ₹15 lakh per individual. - What is the tenure of the Senior Citizens’ Savings Scheme?

The tenure is 5 years, which can be extended by an additional 3 years upon maturity. - How often is interest paid in SCSS?

Interest is paid quarterly (every three months). - Can I withdraw money before maturity?

Yes, premature withdrawal is allowed after 1 year but with a penalty. Withdrawal before 1 year incurs a higher penalty. - Are investments in SCSS eligible for tax deduction?

Yes, investments up to ₹1.5 lakh per year are eligible for tax deduction under Section 80C. - Is the interest earned taxable?

Yes, the interest income from SCSS is taxable according to your income tax slab. - Can I open a joint account in SCSS?

Yes, accounts can be opened jointly with a spouse, but only the primary account holder needs to be a senior citizen. - Where can I open an SCSS account?

At authorized post offices and designated banks across India. - Can the account be transferred if I move to a different city?

Yes, SCSS accounts can be transferred from one post office or bank branch to another. - Is there any nomination facility available?

Yes, you can nominate a family member for the account. - Can I invest more than ₹15 lakh?

No, the maximum investment limit per individual is ₹15 lakh.