1. What is Actively Managed Funds Investing in Stocks?

Actively managed funds investing in stocks are mutual funds where professional fund managers actively select, buy, and sell stocks with the goal of outperforming a specific benchmark index (like the Nifty 50 or Sensex).

Unlike passive funds, which simply mirror an index, active funds rely on in-depth research, market analysis, and strategic decision-making by the fund manager and their team. These funds try to take advantage of market inefficiencies to generate higher returns.

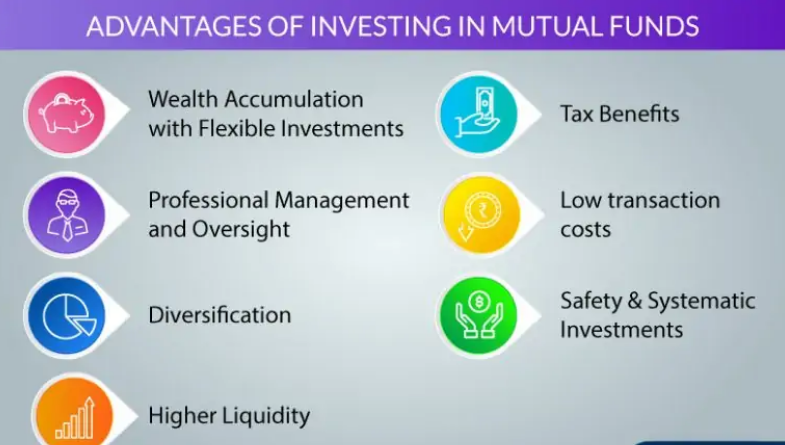

2. Benefits of Actively Managed Funds Investing in Stocks

| Benefit | Explanation |

|---|---|

| Potential for Higher Returns | Fund managers try to outperform market indexes by picking undervalued or growth stocks. |

| Professional Management | Experienced fund managers and analysts handle investment decisions and research. |

| Flexibility | Managers can quickly respond to market changes or economic events by adjusting the portfolio. |

| Diversification | Active funds typically hold a diversified mix of stocks to reduce risk. |

| Access to Research and Insights | Investors benefit from extensive research that individuals may not be able to perform. |

3. Risks of Actively Managed Funds Investing in Stocks

| Risk | Explanation |

|---|---|

| Higher Fees | Active management usually involves higher expense ratios compared to passive funds. |

| No Guaranteed Outperformance | Many actively managed funds fail to beat their benchmark indices over the long term. |

| Manager Risk | Fund performance depends heavily on the skill and decisions of the fund manager. |

| Market Risk | Still exposed to stock market volatility and economic downturns. |

| Style Drift | Fund managers may change investment style, potentially increasing volatility or risk. |

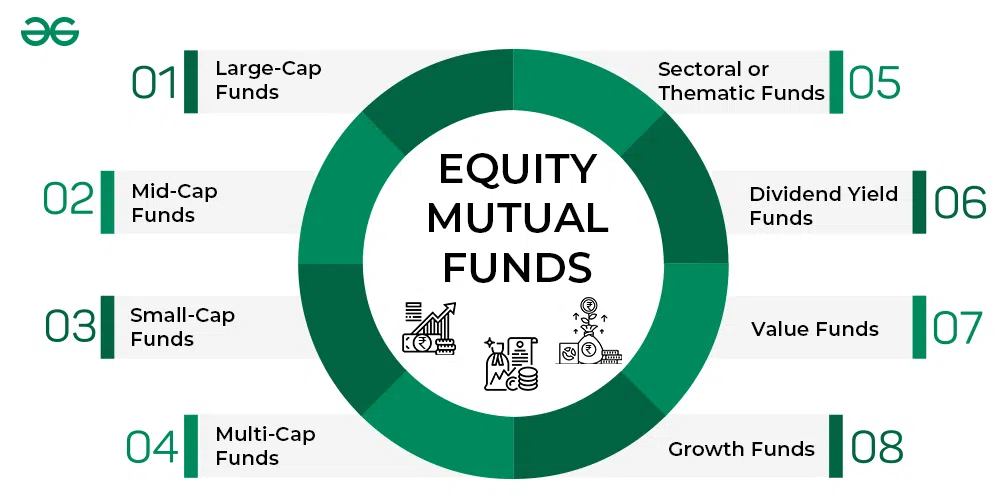

4. Top 10 Actively Managed Equity Mutual Funds in India (2025)

Based on recent market data and performance, here are 10 popular actively managed equity mutual funds in India (note: always check latest data):

| Fund Name | Fund Manager | Fund Type | 5-Year Returns (Approx.) | Expense Ratio | AUM (Approx.) |

|---|---|---|---|---|---|

| Mirae Asset Large Cap Fund | Neelesh Surana | Large Cap Equity Fund | 12-15% | ~1.5% | ₹40,000 Cr+ |

| Axis Bluechip Fund | Chirag Setalvad | Large Cap Equity Fund | 11-14% | ~1.2% | ₹35,000 Cr+ |

| ICICI Prudential Bluechip Fund | Sandeep Sharma | Large Cap Equity Fund | 10-13% | ~1.3% | ₹25,000 Cr+ |

| SBI Bluechip Fund | Manish Gunwani | Large Cap Equity Fund | 10-13% | ~1.2% | ₹20,000 Cr+ |

| HDFC Mid-Cap Opportunities Fund | Chirag Setalvad | Mid Cap Equity Fund | 15-18% | ~1.8% | ₹15,000 Cr+ |

| Kotak Emerging Equity Fund | Rahul Goswami | Mid Cap Equity Fund | 14-17% | ~1.6% | ₹12,000 Cr+ |

| Axis Midcap Fund | Shreyash Devalkar | Mid Cap Equity Fund | 15-19% | ~1.7% | ₹18,000 Cr+ |

| Franklin India Smaller Companies Fund | Venugopal K | Small Cap Equity Fund | 18-22% | ~2.0% | ₹7,000 Cr+ |

| DSP Small Cap Fund | Nilesh Shah | Small Cap Equity Fund | 17-20% | ~1.9% | ₹10,000 Cr+ |

| UTI Equity Fund | Saurabh Mukherjea | Diversified Equity Fund | 13-16% | ~1.5% | ₹15,000 Cr+ |

5. Comparison Table: Top 10 Actively Managed Equity Funds in India

| Fund Name | Pros | Cons |

|---|---|---|

| Mirae Asset Large Cap Fund | Strong performance, consistent, large AUM | Slightly higher expense ratio |

| Axis Bluechip Fund | Consistent returns, good for risk-averse | Large size may limit flexibility |

| ICICI Prudential Bluechip Fund | Strong management, good diversification | Slightly volatile in short term |

| SBI Bluechip Fund | Low expense ratio, steady returns | Moderate exposure to cyclical stocks |

| HDFC Mid-Cap Opportunities | High growth potential, experienced management | Higher volatility and risk compared to large caps |

| Kotak Emerging Equity Fund | Good returns in mid-cap space | Mid-cap risks like liquidity and volatility |

| Axis Midcap Fund | Consistent outperformance in mid-cap | Higher expense ratio |

| Franklin India Smaller Companies | Potential for very high returns | High volatility, riskier than large/mid cap funds |

| DSP Small Cap Fund | Good small-cap exposure, skilled manager | Very volatile, high risk |

| UTI Equity Fund | Diversified portfolio across market caps | Performance can lag in strong bull markets |

6. Frequently Asked Questions (FAQs) About Actively Managed Funds Investing in Stocks

Q1: Are actively managed funds better than passive funds?

A: Not always. Actively managed funds have potential to outperform but often come with higher fees and risks. Passive funds usually offer lower cost and track market returns.

Q2: How much do actively managed funds charge?

A: Expense ratios typically range from 1% to 2.5%, higher than passive funds (around 0.1%-0.5%).

Q3: How to choose an actively managed fund?

A: Look for consistent past performance, experienced fund managers, low churn ratio, reasonable expense ratio, and alignment with your risk profile.

Q4: Can actively managed funds guarantee returns?

A: No. Like all equity investments, returns are subject to market risks and volatility.

Q5: What is the ideal investment horizon?

A: At least 5-7 years to ride out market cycles and benefit from compounding.

Q6: Can I switch from passive to active funds?

A: Yes, investors can switch but should consider tax implications and exit loads.