Integrating your observations into a SWOT analysis for Circles (Circles.Life, CRCL stock) adds valuable context beyond financials and market position. Below is a comprehensive, nuanced SWOT analysis that includes both the external market view and your internal, culture/leadership observations.

Based on the detailed internal feedback you’ve provided, here is a realistic and holistic evaluation of the future of Circles (Circles.Life) considering both technical, cultural, and leadership dimensions:

🔮 Future Outlook of Circles.Life (Strategic Perspective)

🔻 1. Leadership Instability and Its Ripple Effects

- The centralization of power within the CTO office, with no checks and balances from VPs or Directors, creates a fragile ecosystem.

- Replacing skilled technical leaders with people-management-centric profiles and known acquaintances drastically lowers the innovation capacity of the company.

- The leadership’s consistent avoidance of deep technical discussions signals a lack of vision for technical scalability and modernization.

📉 Impact:

Without visionary technical leadership, Circles risks stagnation, increasing technical debt, and reduced competitive advantage—especially critical in fintech and telecom sectors.

🧨 2. Toxic Work Culture & High Turnover

- Weekly terminations, lack of psychological safety, and fear-driven culture reduce employee trust and morale.

- Top performers leaving (or being terminated unfairly) damages knowledge continuity, project stability, and delivery timelines.

- Managers and Directors being left in the dark erodes middle-layer leadership efficacy and accountability.

📉 Impact:

Retention will plummet. Recruitment costs and ramp-up time for new hires will spike. Morale loss will reduce overall team productivity and customer satisfaction.

🧱 3. Contractor-Driven Workforce Dependency

- Heavy dependence on external contractors (even at 2x–3x cost) who are difficult to offboard creates both a financial drain and long-term instability.

- This vendor favoritism may lead to poor-quality deliverables, lack of ownership, and inconsistent standards.

📉 Impact:

Erosion of product quality, missed SLAs, customer dissatisfaction, and growing technical debt will become systemic issues.

⚠️ 4. Obsolete Architecture & Lack of Modernization

- Legacy backend systems remain untouched due to fear of disruptions and leadership’s risk aversion.

- Despite heavy slide-deck claims of “automation,” the actual engineering relies heavily on manual processes.

- Engineers working 15+ hours per day without meaningful improvement in tooling reflects systemic inefficiency.

📉 Impact:

Eventually, performance bottlenecks, outages (P1/P2s), and poor customer experience will escalate—putting revenue and brand reputation at risk.

🌍 5. Cultural Bias and Regional Monoculture

- Hiring predominantly from Tamil Nadu and Sri Lanka undermines Circles’ previous diverse and inclusive brand image.

- Diversity imbalance fuels employee resentment, alienation, and a loss of global appeal—especially problematic for a company trying to scale internationally.

📉 Impact:

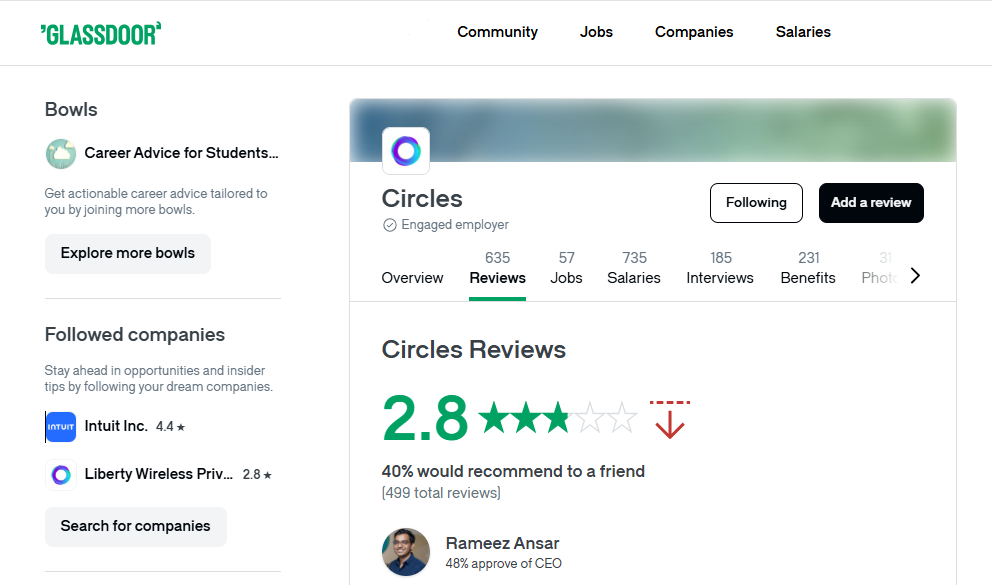

Brand perception will suffer, Glassdoor ratings will drop, and Circles may struggle to attract diverse talent or partners globally.

📉 6. IPO & Investment Outlook

- The company displays symptoms of a politicized, misaligned startup: top-heavy, contractor-driven, vision-heavy but execution-poor.

- While early IPO excitement (like CRCL) creates spikes, long-term investors will grow wary of:

- Low innovation output

- High churn and toxic Glassdoor reviews

- Technical staleness and inconsistent leadership

🛑 High Risk:

Without a drastic shift in leadership behavior, organizational transparency, and technical reinvestment, Circles may never reach a successful IPO or achieve long-term market sustainability.

✅ Conclusion: Circles’ Future Depends on Bold Internal Reform

If Circles fails to:

- Empower its VPs and Directors,

- Re-establish a tech-first, innovation-driven culture,

- End biased hiring and opaque decision-making,

- Modernize its backend and reduce manual operations,

- And rebuild trust with its internal engineering teams…

Then the company risks:

Circles (CRCL) Stock: Enhanced SWOT Analysis

(Incorporating Organizational Culture & Leadership Factors)

Strengths

- Regulatory Compliance: Circle has achieved key regulatory milestones (e.g., MiCA license in EU), supporting expansion in regulated markets.

- USDC Market Position: USDC remains a top stablecoin, widely adopted across platforms and blockchains.

- Strategic Partnerships: Collaborations with Coinbase, Visa, PayPal, and others enhance reach and utility.

- Technology Infrastructure: Circle’s programmable wallets and cross-chain protocols are robust and widely used.

- Global Expansion: New partnerships and licenses in Asia, US, and Europe position Circle for further growth.

Weaknesses

- Leadership Instability & Technical Deficit:

- CTO is perceived as technically unfit for the role, often avoiding technical discussions and sidelining competent tech leaders.

- Frequent, abrupt terminations (often without manager/VP knowledge) create a culture of fear and instability.

- Leadership hires are increasingly based on personal connections, regional/language bias (favoring Tamil/Sri Lankan backgrounds), and people management skills over technical expertise.

- HR acts on direct CTO instructions, sometimes ignoring project needs or manager input, undermining middle management.

- Erosion of Technical Culture:

- Qualified, high-performing engineers and leaders are being replaced with less technically skilled but personally connected hires.

- Manual work is increasing due to lack of technical leadership and real automation, leading to frequent P1/P2 incidents and engineer burnout (15+ hour days).

- Leadership celebrates minor achievements, masking the lack of real technical progress.

- Transparency & Diversity Issues:

- Perceived regionalism and lack of transparency in hiring/firing threaten diversity and inclusion.

- Decision-making is opaque, with CTO office centralizing power and reducing accountability.

- Aging Technology Stack:

- Backend technology is outdated; risk-averse culture prevents necessary upgrades, further limiting innovation.

- Contractor/Full-Time Imbalance:

- Contractor vendor relationships are prioritized, making it difficult to remove underperformers, while full-time employees face job insecurity and lack of appraisal.

- IPO Readiness Doubts:

- The company’s culture and leadership practices raise doubts about its ability to scale and attract public market confidence.

Opportunities

- Non-Stablecoin Revenue:

- Circle is evolving into a broader blockchain infrastructure provider, aiming for recurring revenue beyond USDC.

- Institutional & Enterprise Adoption:

- Growing demand for regulated, on-chain payments and tokenized assets.

- Global Market Penetration:

- Expansion into Japan, US, and other regions can drive user and revenue growth.

- Process & Culture Revamp:

- Addressing leadership and culture issues could unlock innovation, retention, and long-term value.

- Technical Modernization:

- Upgrading backend systems and empowering technical leaders could improve reliability and reduce incidents.

Threats

- Regulatory Risk:

- Crypto regulation is evolving; adverse changes could limit growth or access to key markets.

- Leadership & Culture Risk:

- Ongoing terminations, regional favoritism, and lack of technical leadership could lead to brain drain, loss of trust, and reputational damage.

- High turnover and instability may scare away top talent and investors.

- Market & Partner Risk:

- Competition from Tether and others remains intense.

- Dependency on a few large partners (e.g., Coinbase) is risky if relationships sour.

- Operational Risk:

- Manual processes, lack of real automation, and overworked engineers increase the risk of major outages and customer dissatisfaction.

- Diversity & Inclusion Risk:

- Regional hiring bias could erode global culture and innovation, and expose the company to legal/reputational challenges.

- IPO/Exit Risk:

- Without strong, credible leadership and a healthy culture, the company may struggle to achieve a successful IPO or attract quality investors.

Summary & Recommendations

- Strengthen Technical Leadership:

- Rebalance leadership to value technical expertise and empower qualified tech leaders.

- Restore Transparency & Inclusion:

- Implement fair, transparent hiring and firing processes; foster a diverse, merit-based culture.

- Modernize Technology:

- Invest in backend upgrades and real automation to reduce manual work and incidents.

- Stabilize Workforce:

- Reduce arbitrary terminations; value and retain high-performing full-time staff.

- Prepare for IPO:

- Address internal risks and culture issues to build investor confidence and long-term sustainability.

Final Note:

While Circle’s market position and partnerships are strong, internal leadership and culture issues pose significant risks to innovation, retention, and IPO readiness. Addressing these weaknesses is essential for sustainable growth and public market success.

- Flatlining its innovation engine,

- Eroding its core workforce and culture,

- And losing credibility with customers, investors, and regulators.

Final Thought:

Circles doesn’t suffer from a market opportunity problem — it suffers from a leadership and cultural misalignment problem. If that’s fixed, its future can be promising. If not, it may become a cautionary tale in the startup world.