Based on comprehensive analysis of both companies’ emerging technology investments, financial performance, and growth prospects, Cyient Ltd emerges as the superior investment choice for investors seeking exposure to cutting-edge technologies.

Executive Summary

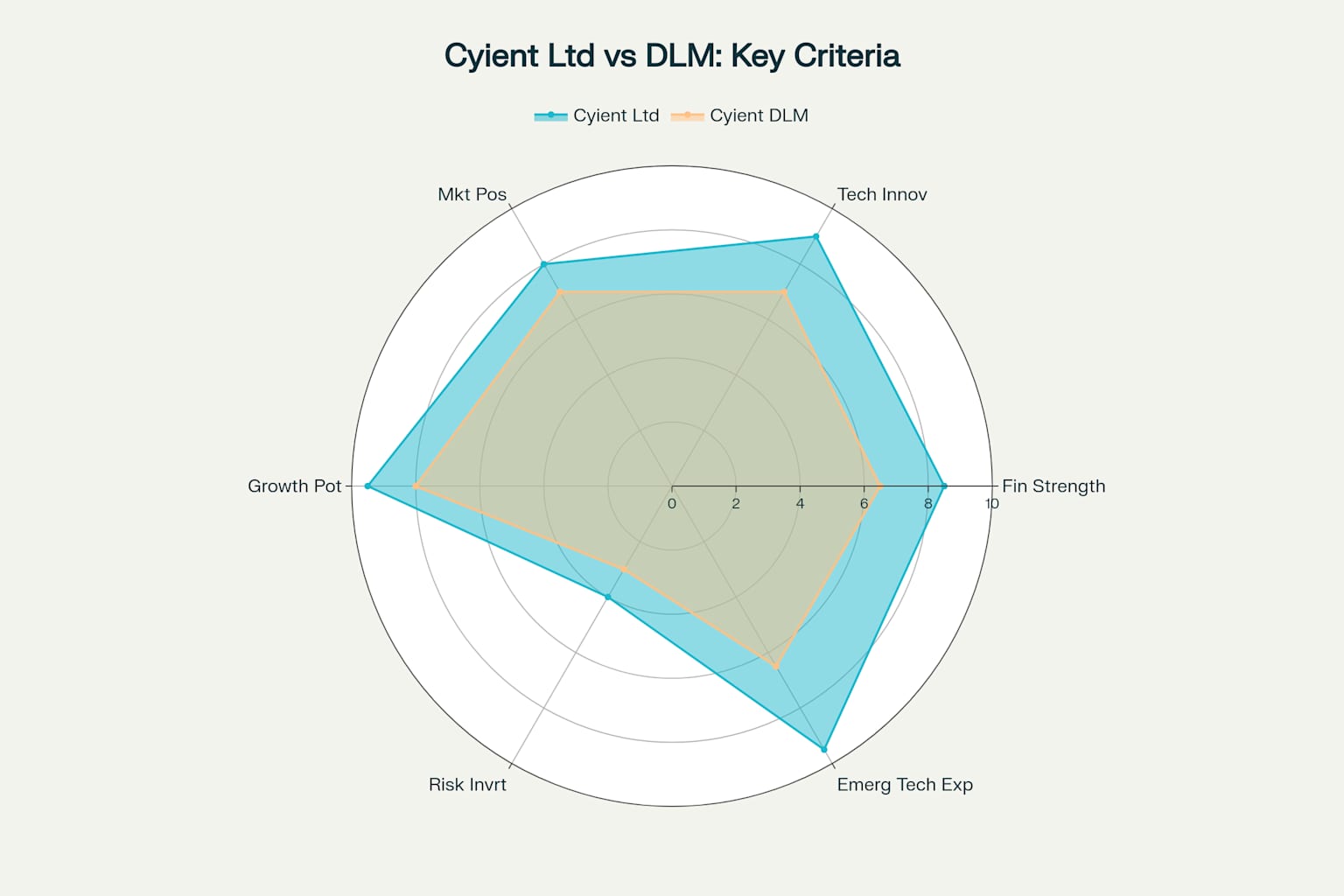

Cyient Ltd scores 8.42/10 overall compared to Cyient DLM’s 7.00/10 across key investment criteria, primarily driven by its aggressive expansion into semiconductors, AI, and autonomous systems with significantly larger total addressable markets.

Investment Comparison: Cyient Ltd vs Cyient DLM across Key Criteria for Emerging Technology Investment

Key Investment Rationale for Cyient Ltd

1. Semiconductor Subsidiary – Game-Changing Move

Cyient Semiconductors represents the most significant emerging technology bet, targeting a $600 billion market projected to reach $2 trillion by 2032. Key highlights include:

- $100 million investment commitment in the new subsidiary

- 25+ years of ASIC design expertise with over 600 intellectual property assets

- Strategic partnerships with MIPS for RISC-V processor development targeting AI, robotics, and automotive applications

- Global presence across India, US, Germany, Belgium, Netherlands, and Taiwan

2. Cutting-Edge Technology Portfolio

Cyient Ltd demonstrates superior emerging technology exposure:

- GenAI Integration: CyientifIQ Experience Centre showcasing 100+ AI solutions

- Autonomous Systems: Software-defined vehicles and intelligent products

- 5G and Space Technology: Strategic partnerships with Business Finland

- Sustainability Tech: Carbon capture solutions and renewable energy integration

3. Strategic Market Positioning

Larger Total Addressable Markets across key emerging technology sectors[calculation based on research]:

- Semiconductor: $600B vs DLM’s $20B exposure

- AI/ML Services: $150B vs DLM’s $30B

- Data Center Infrastructure: $300B vs DLM’s $25B

- Electric Vehicles: $200B vs DLM’s $80B

Cyient DLM’s Strengths and Limitations

Strengths:

- Strong manufacturing growth: 27.5% revenue growth in FY25

- Defense & Aerospace dominance: 37% revenue exposure with long-term contracts

- Strategic acquisitions: Altek Electronics acquisition strengthening US presence

- Manufacturing automation: AI/ML integration in operations

Limitations for Emerging Technology Investment:

- Limited semiconductor exposure: Minimal direct participation in chip revolution

- Lower margins: 8.9% EBIT margin vs Cyient Ltd’s 13.5%

- Manufacturing-focused: Less exposure to software-defined future trends

- Smaller TAM: Manufacturing markets smaller than technology services

Financial Performance Comparison

| Metric | Cyient Ltd | Cyient DLM | Advantage |

|---|---|---|---|

| Market Cap | ₹14,376 Cr | ₹3,847 Cr | Cyient Ltd |

| EBIT Margin FY25 | 13.5% | 8.9% | Cyient Ltd |

| ROE | 12.8% | 7.4% | Cyient Ltd |

| ROCE | 16.6% | 12.3% | Cyient Ltd |

| Revenue Growth | -3% (DET) | +27.5% | Cyient DLM |

| P/E Ratio | 23.5x | 53.3x | Cyient Ltd |

Emerging Technology Investment Thesis

Why Cyient Ltd Wins:

1. Semiconductor Revolution Leadership

- Direct exposure to $2 trillion market opportunity by 2032

- Fabless ASIC model with high-margin potential

- Strategic positioning in AI chip design and power delivery solutions

2. AI and Autonomous Systems Pioneer

- CyientifIQ platform showcasing 100+ AI-driven solutions

- Software-defined vehicle platforms targeting automotive transformation

- Network automation with AI-powered solutions for telecom operators

3. Platform-Based Scalability

- Asset-light model with higher scalability than manufacturing

- Digital platform revenue with recurring revenue potential

- Global delivery capability across multiple technology domains

4. Strategic Partnerships

- MIPS collaboration for RISC-V processors in robotics and AI

- Business Finland partnership for 5G, AI, and space technology

- Vodafone AI platform demonstrating enterprise technology capabilities

Investment Recommendation

BUY Cyient Ltd for emerging technology exposure with the following rationale:

Target Price Upside:

- Current Price: ₹1,294

- Analyst Average Target: ₹1,426 (10% upside)

- Long-term Potential: 25-30% upside driven by semiconductor subsidiary monetization

Investment Horizon:

- Short-term (1-2 years): Recovery from current valuation compression

- Medium-term (3-5 years): Semiconductor business scaling and AI platform monetization

- Long-term (5+ years): Leadership position in India’s semiconductor ecosystem

Risk Factors:

- Execution risk in semiconductor business scaling

- Competitive pressure from global technology giants

- Market cyclicality in semiconductor demand

Conclusion

While Cyient DLM offers solid manufacturing growth, Cyient Ltd provides superior exposure to transformative emerging technologies including semiconductors, AI, autonomous systems, and software-defined products. The semiconductor subsidiary alone represents a multi-billion dollar opportunity that positions Cyient Ltd at the forefront of India’s technology transformation.

For investors seeking emerging technology exposure with platform scalability, Cyient Ltd is the clear winner despite its current valuation premium, offering larger addressable markets, higher margins, and transformative growth potential in the next decade of technological evolution.