What is Equity Mutual Fund?

Equity Mutual Funds are investment schemes that pool money from multiple investors to invest primarily in the stock market (equities). These funds invest in shares of companies aiming for capital appreciation over the long term. The goal is to generate higher returns by taking exposure to equity markets.

Benefits of Equity Mutual Funds

| Benefit | Explanation |

|---|---|

| Potential for High Returns | Historically, equities have offered higher returns compared to other assets over the long term. |

| Diversification | They invest in a diversified portfolio of stocks, reducing the risk of individual stocks. |

| Professional Management | Fund managers manage the portfolio, making it easier for investors to invest without deep market knowledge. |

| Liquidity | Equity mutual fund units can be bought or sold on any business day. |

| Convenience and Affordability | Allows investors to start with small amounts, making stock market exposure accessible. |

Risks of Equity Mutual Funds

| Risk | Explanation |

|---|---|

| Market Risk | Since these funds invest in equities, they are subject to stock market fluctuations. |

| Volatility | Prices of stocks can be volatile in the short term, leading to value swings. |

| Management Risk | The performance depends on the fund manager’s decisions. |

| Economic/Political Risk | Economic downturns or political instability can adversely impact equity markets. |

Top 10 Equity Mutual Funds in India (As of 2025 approx.)

Here is a comparative table of popular equity mutual funds in India. Please note that the actual top funds may vary based on latest performance, AUM, and rating updates:

| Fund Name | Category | Pros | Cons |

|---|---|---|---|

| Axis Bluechip Fund | Large Cap | Consistent performance, low expense ratio | Less exposure to mid/small caps |

| Mirae Asset Large Cap Fund | Large Cap | Strong track record, diversified portfolio | High AUM can limit flexibility |

| SBI Small Cap Fund | Small Cap | High growth potential | High volatility and risk |

| ICICI Prudential Equity & Debt Fund | Hybrid (Equity-oriented) | Balanced risk and return | Moderate returns compared to pure equity funds |

| Kotak Standard Multicap Fund | Multicap | Flexible investment across market caps | Slightly higher expense ratio |

| HDFC Mid-Cap Opportunities Fund | Mid Cap | Good long-term growth potential | Riskier than large cap funds |

| Nippon India Small Cap Fund | Small Cap | Strong track record, aggressive growth | Volatile, higher risk |

| UTI Nifty Index Fund | Index Fund | Low cost, tracks benchmark index | Limited to index performance, no active management |

| DSP Equity Fund | Large & Mid Cap | Well-diversified portfolio, consistent performance | Moderate risk |

| L&T Emerging Businesses Fund | Mid & Small Cap | Potential for high growth | High risk, volatile |

FAQ on Equity Mutual Funds

1. What is an Equity Mutual Fund?

Equity Mutual Funds are investment schemes that primarily invest in stocks or shares of companies with the aim of generating long-term capital appreciation.

2. Is it safe to invest in Equity Mutual Funds?

Equity funds carry market-related risks. While not risk-free, they can offer higher returns over the long term. Risk can be managed by diversification and staying invested longer.

3. Who should invest in Equity Mutual Funds?

They are suitable for investors with a moderate to high risk appetite and a long-term investment horizon of at least 5 years.

4. How do I invest in an Equity Mutual Fund?

You can invest through SIPs (Systematic Investment Plans) or lump sum, via fund houses, brokers, or online platforms like Groww, Zerodha, Paytm Money, etc.

5. What is the minimum amount required to invest?

You can start SIPs with as low as ₹500 per month, depending on the fund’s policy.

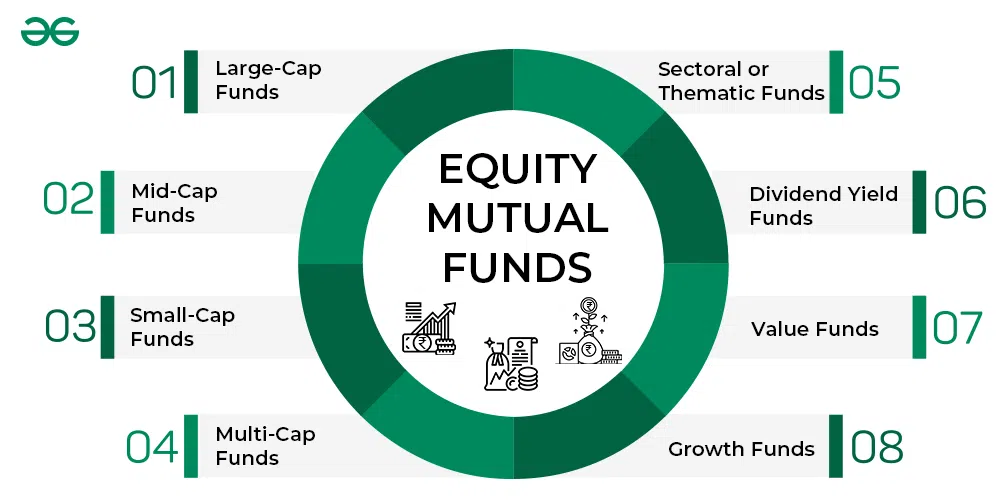

6. What are the types of Equity Mutual Funds?

- Large Cap Funds

- Mid Cap Funds

- Small Cap Funds

- Multi Cap Funds

- ELSS (Tax-saving funds)

- Sectoral/Thematic Funds

7. What is the lock-in period for Equity Mutual Funds?

Most equity mutual funds are open-ended and have no lock-in. However, ELSS funds have a 3-year lock-in.

8. Are returns from Equity Mutual Funds taxable?

Yes.

- Short-term capital gains (STCG): 15% tax if sold within 1 year

- Long-term capital gains (LTCG): 10% tax on gains above ₹1 lakh after 1 year

9. What is an expense ratio in mutual funds?

It’s the annual fee charged by the fund house for managing your investments. Lower expense ratios are better for long-term returns.

10. What is the difference between Direct and Regular plans?

- Direct Plan: Invested directly with AMC, lower expense ratio, no commission

- Regular Plan: Invested via a distributor, higher expense ratio, includes commission

11. Can I withdraw money anytime from Equity Mutual Funds?

Yes, except for ELSS funds. Most funds offer daily liquidity, but exit load may apply if withdrawn early.

12. How long should I stay invested in Equity Funds?

Ideally, for 5 years or more to ride out market volatility and benefit from compounding.