What is Post Office Monthly Income Scheme (POMIS)?

The Post Office Monthly Income Scheme (POMIS) is a government-backed savings scheme in India offered by India Post. It is designed to provide a fixed monthly income to the investor. It is a safe and low-risk investment option where investors deposit a lump sum amount, and the interest is paid out monthly as income.

- Objective: Provide regular monthly income to senior citizens, retirees, and other investors looking for steady returns.

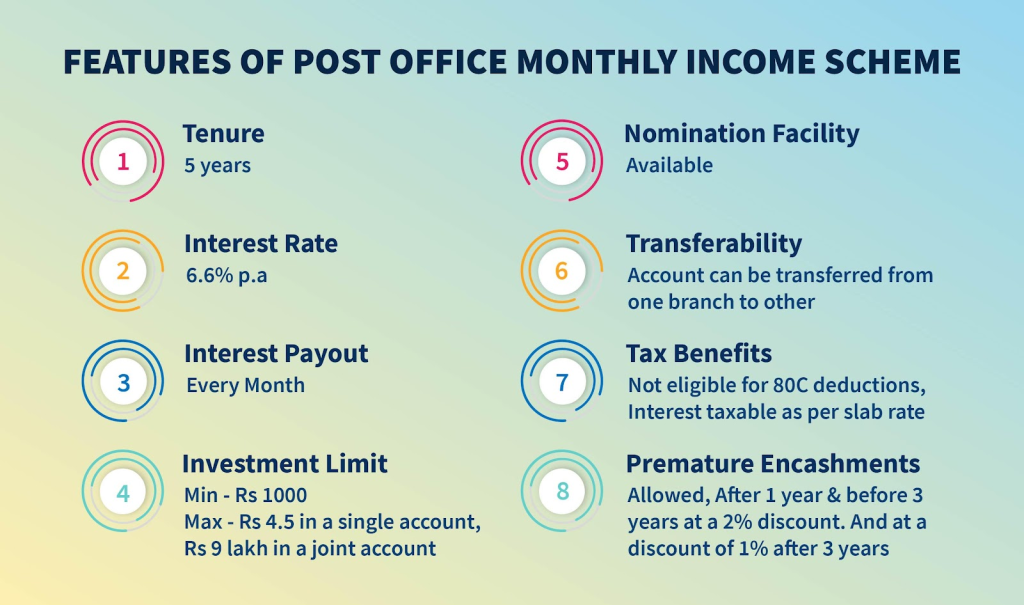

- Investment Tenure: 5 years.

- Interest Rate: Fixed by the government and revised periodically (typically quarterly).

- Interest Payment: Monthly payout (on the 4th of every month).

- Minimum Investment: ₹1,500 (in multiples of ₹1,500 thereafter).

- Maximum Investment: ₹4.5 lakhs per individual (₹9 lakhs for joint accounts).

Benefits of Post Office Monthly Income Scheme (POMIS)

| Benefit | Explanation |

|---|---|

| Guaranteed Returns | Backed by the Government of India, so it carries almost no default risk. |

| Regular Monthly Income | Interest is paid monthly, providing a steady cash flow, ideal for retirees or those needing income. |

| Safety of Principal | Investment is secured by the government, protecting principal amount invested. |

| Tax Benefits on Investment | The principal invested is eligible for tax benefits under Section 80C (up to ₹1.5 lakh). |

| No TDS Deducted | No Tax Deducted at Source (TDS) on interest payments, though interest is taxable. |

| Nomination Facility | Investors can nominate a beneficiary to secure the investment in case of death. |

| Loan Against Deposit | Loans can be availed against the deposit amount after 1 year of investment. |

Risks of Post Office Monthly Income Scheme (POMIS)

| Risk | Explanation |

|---|---|

| Interest Rate Risk | Interest rates are fixed at investment time and may not keep up with inflation or market rates. |

| Inflation Risk | Returns might not outpace inflation, leading to erosion of purchasing power over time. |

| Taxability of Interest | Interest earned is fully taxable as per the investor’s income tax slab. |

| Liquidity Risk | Premature withdrawal is allowed only after one year but may attract penalties or loss of interest. |

| Investment Cap | Limited investment amount ceiling (₹4.5 lakh individual, ₹9 lakh joint) restricts large investments. |

| No Growth in Principal | Only interest income is paid monthly; principal is returned at maturity, with no compounding. |

Top 10 Post Office Schemes (Including POMIS) in India

Since POMIS itself is a single scheme, below are Top 10 popular post office savings and income schemes including POMIS, along with their brief description:

| Scheme Name | Objective | Tenure | Interest Payout |

|---|---|---|---|

| 1. Post Office Monthly Income Scheme (POMIS) | Monthly income for retirees | 5 years | Monthly |

| 2. Post Office Savings Account | Basic savings with easy access | No fixed tenure | Interest quarterly |

| 3. Post Office Time Deposit | Fixed deposits with varied tenure | 1, 2, 3, 5 years | Quarterly or at maturity |

| 4. Post Office Recurring Deposit | Regular monthly deposits | 5 years | At maturity |

| 5. Public Provident Fund (PPF) | Long-term savings with tax benefits | 15 years | Annual |

| 6. Senior Citizens Savings Scheme (SCSS) | Regular income for senior citizens | 5 years | Quarterly |

| 7. Sukanya Samriddhi Yojana | Savings scheme for girl child | 21 years | Annual |

| 8. Kisan Vikas Patra (KVP) | Double your money in a fixed period | ~124 months | At maturity |

| 9. National Savings Certificate (NSC) | Fixed maturity investment with tax benefits | 5 or 10 years | At maturity |

| 10. Monthly Income Account (MIA) | Similar to POMIS but with slightly different rules | 5 years | Monthly |

Comparison of Top Post Office Income/Savings Plans (Including POMIS)

| Scheme | Tenure | Interest Rate (approx.) | Interest Payout | Pros | Cons |

|---|---|---|---|---|---|

| POMIS | 5 years | 6.6% – 7.1% | Monthly | Guaranteed monthly income, govt backed, safe | Interest taxable, limited max investment |

| Senior Citizens Savings Scheme (SCSS) | 5 years | 7.4% – 7.6% | Quarterly | Higher interest than POMIS, good for seniors | Interest taxable, lock-in period |

| Post Office Time Deposit | 1-5 years | 5.5% – 7.1% | Quarterly or maturity | Flexible tenures, safe, good for lump sum | No monthly payout option |

| Public Provident Fund (PPF) | 15 years | 7.1% | Annual | Tax-free returns, long-term compounding | Long lock-in period, no monthly payouts |

| Monthly Income Account (MIA) | 5 years | Similar to POMIS | Monthly | Similar monthly payout, govt backed | Similar limits as POMIS |

| Recurring Deposit | Up to 10 years | 5.5% – 7% | At maturity | Encourages monthly savings | No monthly interest payout, interest taxable |

| Kisan Vikas Patra (KVP) | ~124 months | ~6.9% | At maturity | Principal doubles in fixed time | No interim payouts, interest compounded |

| National Savings Certificate (NSC) | 5 or 10 years | 6.8% – 7.1% | At maturity | Tax benefits under 80C | No monthly income payout |

| Savings Account | No fixed tenure | 2.7% – 4% | Quarterly | Easy liquidity, daily transactions | Low interest rate |

| Sukanya Samriddhi Yojana | 21 years | 7.6% | Annual | Tax benefits, promotes girl child education | Long lock-in period, no monthly payouts |

FAQs for Post Office Monthly Income Scheme (POMIS)

Q1: Who can open a POMIS account?

A: Any Indian resident individual, joint account holders (up to 3), or on behalf of minors can open an account.

Q2: What is the minimum and maximum investment limit?

A: Minimum ₹1,500; maximum ₹4.5 lakh for individuals and ₹9 lakh for joint accounts.

Q3: How is interest calculated and paid?

A: Interest is calculated quarterly but paid monthly, credited on the 4th of every month.

Q4: Is the interest earned taxable?

A: Yes, interest income is taxable as per the individual’s tax slab.

Q5: Can premature withdrawal be done?

A: Premature withdrawal is allowed only after 1 year but with penalties (usually reduced interest).

Q6: Can I open multiple POMIS accounts?

A: Yes, but the total investment must not exceed the prescribed limits.

Q7: Is the POMIS account transferable?

A: Yes, the account can be transferred from one post office to another.

Q8: Can nomination be made?

A: Yes, nomination is allowed for the security of the account.

Q9: How to open a POMIS account?

A: You can open an account at any post office by submitting KYC documents and making the deposit.

Q10: What happens on maturity?

A: The principal amount is returned, and interest payments cease. You can choose to reinvest.