Fixed Income, 5-Year Tenure, Interest Taxable refers to a type of investment where the principal amount is invested in a financial product, typically a fixed deposit or bond, that provides regular interest payments over a fixed period of 5 years. The fixed income aspect means that the returns (interest) are predetermined and are paid at regular intervals, providing predictable cash flow to the investor.

- 5-Year Tenure indicates that the investment is locked in for a 5-year period, and the investor cannot access the funds until the maturity date without incurring penalties.

- Interest Taxable means that the interest earned on this investment is subject to income tax based on the investor’s tax bracket. For example, if an individual falls in a higher income tax bracket, a larger portion of the interest income will be taxed, reducing the net return.

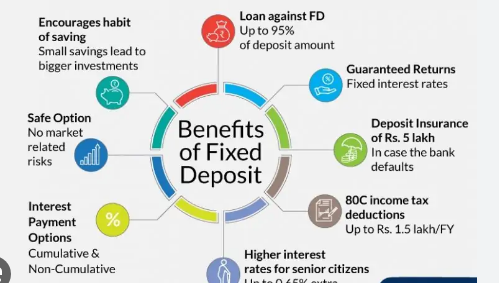

Benefits of Fixed Income, 5-Year Tenure, Interest Taxable

Stable and Predictable Returns

Fixed income investments provide a predictable and stable source of income. The interest is fixed, meaning you will know exactly how much you will earn over the 5-year period, regardless of market conditions.

Capital Preservation

These investments are typically low-risk, as they focus on preserving the initial principal while offering modest returns. This makes them ideal for conservative investors who prioritize safety over high returns.

Low Risk

Compared to equities, fixed income investments carry lower risk because they are typically backed by reputable financial institutions like banks or government entities. As long as the issuer is financially stable, the likelihood of losing your principal is minimal.

Tax Deduction at Source (TDS)

In India, if your interest income exceeds ₹40,000 (₹50,000 for senior citizens), TDS is deducted at the rate of 10% on fixed deposit interest. This simplifies tax filing as tax is already deducted at the source.

Diversification of Investment Portfolio

Including fixed income products in your portfolio helps diversify risk. A mix of equity, real estate, and fixed-income investments provides balance, particularly during market downturns.

Suitable for Conservative Investors

Fixed income investments are ideal for those with a lower risk tolerance, such as retirees, risk-averse individuals, or those looking for steady income without volatility.

Regular Cash Flow

Depending on the investment, you can receive regular interest payouts (monthly, quarterly, or yearly), which can serve as a source of income for meeting ongoing financial needs, such as paying bills or supporting daily expenses.

Liquidity Options

While fixed for 5 years, some plans allow partial withdrawals or offer premature withdrawal with a penalty. This provides some degree of flexibility if your circumstances change, though you may not have complete access to the funds without incurring charges.

No Market Dependency

The performance of fixed income instruments is not linked to market conditions like stocks or mutual funds, so it provides stability even during market fluctuations.

Ideal for Tax Planning

While the interest is taxable, fixed income products can be planned in a way to optimize your tax liabilities, such as investing in tax-saving FDs that qualify for deductions under Section 80C of the Income Tax Act.

Senior Citizen Benefits

Many banks and financial institutions offer higher interest rates for senior citizens, providing better returns for those over the age of 60.

Easy to Manage

Fixed income investments are relatively simple to understand and manage. You don’t need to actively monitor the market, as the returns are fixed and the investment is less complicated compared to equities or other market-linked products.

Risks of Fixed Income, 5-Year Tenure, Interest Taxable

- Interest Rate Risk

- Explanation: Fixed income investments are sensitive to changes in interest rates. If interest rates rise after you’ve locked in your investment, the market value of your fixed-income asset (such as a fixed deposit or bond) may decline. This means that if you choose to liquidate your investment before maturity, you may not get the full value.

- Impact: Your returns could be lower if the market offers higher rates than your fixed-income investment.

- Inflation Risk

- Explanation: The interest rate on fixed income investments is fixed, which means your returns may not keep pace with inflation. If inflation rises during your 5-year tenure, the purchasing power of your interest income will decrease, leading to a loss in real value.

- Impact: High inflation can erode the value of your returns, reducing the actual worth of your investment in terms of purchasing power.

- Credit Risk

- Explanation: There is a risk that the issuer of the fixed income product (such as a bank or corporation) may default on their obligation to pay back the principal or interest. While this is a smaller risk for government-backed or bank-issued instruments, it’s more significant for corporate bonds or non-banking financial companies (NBFCs).

- Impact: If the issuer defaults, you may lose part or all of your investment. This risk is higher with lower-rated issuers.

- Liquidity Risk

- Explanation: Fixed income products like 5-year fixed deposits often have a lock-in period, meaning you cannot access your funds without penalties until the maturity date. Even though some plans may allow partial withdrawals or early redemption, you may face charges or lose out on interest benefits.

- Impact: If you face an emergency and need to access your money before the 5 years are up, you may incur a penalty or receive less than you originally invested.

- Taxation Risk

- Explanation: The interest earned from fixed income investments is fully taxable based on your tax bracket, which can significantly reduce the actual return you receive from the investment.

- Impact: High-income earners may face a high tax liability, which could lower the net returns from the fixed income investment. Additionally, changes in tax policies could affect future returns.

- Reinvestment Risk

- Explanation: At the end of the 5-year tenure, when the investment matures, you may need to reinvest the principal amount. If interest rates have fallen since your initial investment, the returns on reinvested funds could be lower than before.

- Impact: You may not be able to reinvest the amount at the same or a higher rate, reducing your future income.

- Prepayment Risk (in case of bonds)

- Explanation: In the case of fixed income instruments like bonds, the issuer might choose to repay the principal earlier than expected if interest rates decline (i.e., if they can borrow at a cheaper rate).

- Impact: This could force you to reinvest the returned principal at a lower rate, reducing your expected returns.

- Opportunity Cost

- Explanation: When you lock in your funds for a 5-year tenure, you may miss out on other investment opportunities that offer better returns, such as equities, mutual funds, or real estate, especially in a growing market.

- Impact: Your funds could be tied up in a lower-return investment while other assets might be offering better growth opportunities.

- Issuer’s Financial Stability

- Explanation: Fixed income instruments backed by financial institutions, especially non-banking financial companies (NBFCs) or private companies, can be riskier than those backed by government entities or top-rated banks. If the financial institution faces a crisis or liquidity problem, they may struggle to meet their financial obligations.

- Impact: You could face a loss in principal if the issuer defaults.

- Penalties for Early Withdrawal

- Explanation: Many fixed income products, like fixed deposits, charge a penalty for early withdrawal. These penalties could result in losing a portion of the interest that would have otherwise accrued over the tenure.

- Impact: You may not get the expected return if you need to access your investment early.

Top 10 Fixed Income Plans in India (5-Year Tenure, Interest Taxable)

| Plan Name | Issuer | Interest Rate (Approx.) | Pros | Cons |

|---|---|---|---|---|

| SBI Fixed Deposit | State Bank of India | 6.5% – 7.0% p.a. | High credibility, wide branch network | Interest taxable, premature withdrawal penalty |

| HDFC Bank Fixed Deposit | HDFC Bank | 6.4% – 6.9% p.a. | Competitive rates, online management | Penalty on early withdrawal |

| PNB Fixed Deposit | Punjab National Bank | 6.5% – 7.1% p.a. | Trusted PSU bank, flexible tenures | Interest taxable, moderate liquidity risk |

| ICICI Bank Fixed Deposit | ICICI Bank | 6.3% – 6.9% p.a. | Good digital access, competitive rates | Penalties for early withdrawal |

| LIC Fixed Deposit | Life Insurance Corp | 6.0% – 6.75% p.a. | Backed by LIC, trustworthy | Slightly lower rates, interest taxable |

| Bajaj Finance Fixed Deposit | Bajaj Finance | 7.0% – 7.5% p.a. | Higher interest rates, monthly interest option | Non-banking finance company (NBFC) risk |

| Mahindra Finance FD | Mahindra Finance | 7.0% – 7.4% p.a. | Attractive interest, flexible payouts | NBFC risk, taxable interest |

| Axis Bank Fixed Deposit | Axis Bank | 6.3% – 6.9% p.a. | Good customer service, online facility | Taxable interest, early withdrawal charges |

| Tata Capital Fixed Deposit | Tata Capital | 6.9% – 7.3% p.a. | Higher interest rates, trusted brand | NBFC risk, interest taxable |

| Bank of Baroda FD | Bank of Baroda | 6.4% – 7.0% p.a. | PSU bank trust, decent rates | Interest taxable, lesser branches |

Comparison Table: Pros and Cons of Top Fixed Income Plans (5-Year, Taxable Interest)

| Plan | Interest Rate | Safety/Credibility | Liquidity | Tax Impact | Customer Service | Suitable For |

|---|---|---|---|---|---|---|

| SBI FD | 6.5%-7.0% | Very High | Moderate (lock-in) | Fully taxable | Excellent | Conservative investors |

| HDFC Bank FD | 6.4%-6.9% | High | Moderate | Fully taxable | Very Good | Retail investors |

| PNB FD | 6.5%-7.1% | High | Moderate | Fully taxable | Good | Medium risk takers |

| ICICI Bank FD | 6.3%-6.9% | High | Moderate | Fully taxable | Very Good | Online savvy investors |

| LIC FD | 6.0%-6.75% | Very High | Moderate | Fully taxable | Good | Conservative, LIC loyalists |

| Bajaj Finance FD | 7.0%-7.5% | Medium (NBFC) | Moderate | Fully taxable | Good | Higher yield seekers |

| Mahindra Finance FD | 7.0%-7.4% | Medium (NBFC) | Moderate | Fully taxable | Good | Risk tolerant investors |

| Axis Bank FD | 6.3%-6.9% | High | Moderate | Fully taxable | Good | Bank customers |

| Tata Capital FD | 6.9%-7.3% | Medium (NBFC) | Moderate | Fully taxable | Good | Yield focused investors |

| Bank of Baroda FD | 6.4%-7.0% | High | Moderate | Fully taxable | Moderate | PSU bank preference |

FAQs for Fixed Income, 5-Year Tenure, Interest Taxable

- What is fixed income, and how does it work?

- Answer: Fixed income refers to investments that provide regular interest payments, typically at a fixed rate, over a specific period. Examples include fixed deposits, bonds, and other debt securities. The principal is usually returned at maturity, and interest is paid regularly or at the end of the tenure.

- Is the interest earned on fixed income investments taxable?

- Answer: Yes, the interest earned from fixed income investments is taxable. It is added to your total income and taxed as per your applicable income tax slab. Banks generally deduct tax at source (TDS) on interest exceeding ₹40,000 (₹50,000 for senior citizens) annually.

- What are the tax implications for a 5-year fixed deposit?

- Answer: The interest on a 5-year fixed deposit is fully taxable as per your income tax slab. If the interest exceeds ₹40,000 (₹50,000 for senior citizens), TDS will be deducted. You can also claim the interest income as part of your total taxable income during tax filing.

- Can I withdraw my fixed deposit before the 5-year tenure?

- Answer: Yes, you can withdraw a fixed deposit before maturity, but you may incur a penalty. This penalty typically includes a reduction in the interest rate, which means you’ll receive less interest than expected.

- Is there any tax-saving benefit for fixed deposits with a 5-year tenure?

- Answer: Yes, fixed deposits with a tenure of 5 years qualify for tax benefits under Section 80C of the Income Tax Act. This allows you to claim a deduction of up to ₹1.5 lakh from your taxable income. However, the interest earned on these deposits is still taxable.

- What is TDS, and how is it applied to fixed deposit interest?

- Answer: Tax Deducted at Source (TDS) is the tax deducted by the bank or financial institution before paying you the interest. For fixed deposit interest above ₹40,000 (₹50,000 for senior citizens), TDS is deducted at the rate of 10%. If your total income is below the taxable threshold, you can submit Form 15G or 15H to avoid TDS deduction.

- Can I change the nominee for my fixed deposit investment?

- Answer: Yes, you can change the nominee for your fixed deposit at any time by submitting a request to the bank or financial institution where you have the deposit.

- Are there any risks associated with fixed income investments?

- Answer: While fixed income investments are generally considered low risk, they do carry some risks such as interest rate risk, credit risk, and inflation risk. If interest rates rise, the value of your fixed income investment may decrease. Also, there is a risk of default by the issuer, especially in the case of corporate bonds or non-banking financial companies (NBFCs).

- How do I calculate the interest earned on a fixed deposit?

- Answer: The interest on a fixed deposit is calculated based on the principal amount, the interest rate, and the duration of the deposit. The formula for simple interest is:

Interest = Principal × Rate × Time

For compound interest, it is calculated based on the frequency of compounding (quarterly, monthly, etc.).

- Answer: The interest on a fixed deposit is calculated based on the principal amount, the interest rate, and the duration of the deposit. The formula for simple interest is:

- What is the best option for tax saving if I want a fixed income investment?

- Answer: A 5-year tax-saving fixed deposit under Section 80C is one of the best options for tax saving. It allows you to claim up to ₹1.5 lakh as a deduction from your taxable income. However, keep in mind that the interest earned on these deposits is still taxable.

- How do I choose the best fixed income investment?

- Answer: When choosing a fixed income investment, consider factors such as the interest rate, tax implications, issuer credibility, and your investment horizon. If you are looking for safety, prefer investments from government banks or public sector institutions. For higher returns, private banks or non-banking financial companies (NBFCs) may offer better rates, though they come with higher risk.

- Is it worth investing in fixed income if interest rates are low?

- Answer: Fixed income investments may not be as attractive when interest rates are low because the returns are fixed and can offer lower yields. However, they are still suitable for capital preservation and for investors seeking regular income without the risk of market volatility.