Filing your income tax return no longer needs to be confusing or time-consuming! The Income Tax e-Filing Portal (https://www.incometax.gov.in) is a powerful digital platform built by the Government of India to simplify everything — from filing returns, checking refunds, and viewing tax credits to responding to notices and verifying filings online.

But before you can file your return, you need one essential thing — registration on the e-Filing Portal.

In this blog, we’ll walk you through what the portal is, why registration matters, and a clear, detailed step-by-step process with all the terms explained. Whether you’re a first-time taxpayer, a salaried employee, or a small business owner, this tutorial will make the process smooth and stress-free.

💡 What is the Income Tax e-Filing Portal?

The Income Tax e-Filing Portal is India’s official government platform managed by the Central Board of Direct Taxes (CBDT). It allows individuals and entities to file returns, pay taxes, check Form 26AS (tax credit statements), download AIS/TIS, update details, and verify returns electronically — all from the comfort of your home.

Think of it as your digital tax office, available 24×7.

📖 Key Terms You Should Know Before Registering

Before we start, let’s clear up a few important terms:

| Term | Meaning |

|---|---|

| PAN (Permanent Account Number) | A unique 10-character alphanumeric ID issued by the Income Tax Department. It acts as your User ID for the portal. |

| Aadhaar | A 12-digit identification number issued by UIDAI. It’s often linked to your PAN and used for OTP-based verification. |

| OTP (One-Time Password) | A code sent to your mobile/email during registration to confirm your identity. |

| DSC (Digital Signature Certificate) | A secure digital key used by companies and professionals to sign tax documents electronically. |

| Form 26AS / AIS (Annual Information Statement) | Statements showing tax deducted, paid, or collected on your behalf. |

| e-Verify | A process to electronically confirm your filed return — replacing physical signatures or postal submission. |

🧩 Why You Should Register

Registration is your first step toward tax compliance. Once registered, you can:

- File or revise your Income Tax Returns (ITR) online.

- View all taxes paid on your behalf (TDS, advance tax, etc.).

- Track refunds directly in your bank account.

- Receive important notifications and respond to them securely.

- Access your Form 26AS and AIS for accurate filing.

🧭 Step-by-Step Registration Guide

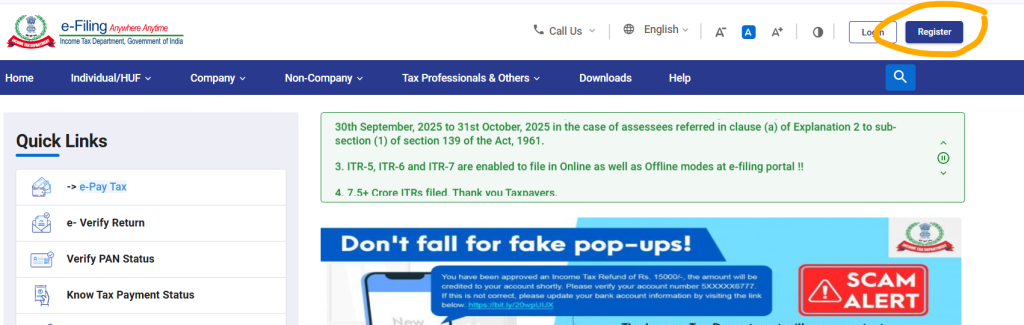

Step 1 — Visit the Official Portal

Go to https://www.incometax.gov.in.

Click on the “Register” button on the top-right corner of the homepage.

🟢 Tip: Always type the URL directly or use bookmarks — avoid third-party links to prevent phishing.

Step 2 — Choose Your User Type

Select the appropriate user category:

- 👤 Individual — salaried, freelancers, pensioners, students, etc.

- 🏢 Company, Firm, HUF, Trust, or AOP/BOI — if you are registering a business entity.

👉 For most people, the correct choice is “Individual.”

Step 3 — Enter PAN and Basic Details

- Enter your PAN, which becomes your User ID.

- Fill in:

- Full Name (as per PAN)

- Date of Birth / Incorporation

- Residential Status (Resident / Non-Resident)

- Mobile Number and Email ID

Make sure these match your PAN database, or your registration will fail.

Step 4 — Verify Using OTP

You’ll receive two OTPs — one on your mobile and one on your email.

Enter both correctly to confirm your identity.

🟢 Why this step matters: OTP verification ensures no one else can register your PAN without your consent.

Step 5 — Create Password and Secure Message

Set a strong password (minimum 8 characters, mix of letters, numbers & symbols).

Add a personalized login message — for example, “Welcome Rohan!” — which appears every time you log in.

This helps confirm you’re on the official site, not a fake one.

Step 6 — Confirm and Register

Click “Register”, review your information, and confirm.

🎉 You’ll see a “Registration Successful” message on the screen.

You can now log in anytime using:

- User ID: Your PAN

- Password: The one you just created

✅ Post-Registration Must-Do Actions

- Login & Complete Profile: Add or verify your address, contact details, and bank account for refunds.

- Link PAN with Aadhaar: Mandatory for filing returns (if not already done).

- Add Bank Accounts: Required to receive tax refunds.

- Check Form 26AS & AIS: Verify your income and TDS details.

- Set Up Security Questions: For easy recovery if you forget your password.

- Familiarize Yourself with the Dashboard: Explore “e-File,” “Pending Actions,” “View Returns,” etc.

🔒 Security Best Practices

- Always log in through https://www.incometax.gov.in.

- Never share your password or OTP with anyone.

- Use a strong, unique password — not the same as your bank or social media logins.

- Check your login message every time to ensure you’re on the official site.

- Update your mobile number and email ID regularly.

⚙️ Troubleshooting Common Issues

| Problem | Cause | Solution |

|---|---|---|

| OTP not received | Network issue or wrong contact | Retry, check spam folder, or update contact details. |

| Name mismatch with PAN | PAN database has different details | Update PAN via NSDL/UTI portal. |

| Already registered | PAN registered earlier | Use “Forgot Password” to reset credentials. |

| Aadhaar not linked | PAN & Aadhaar mismatch | Correct details and link Aadhaar again under Profile Settings. |

🧾 What Happens After Registration?

You can now:

- File your ITR (Income Tax Return) online.

- View and download Form 26AS, AIS, and TIS.

- Track refund status in real time.

- e-Verify your return using Aadhaar OTP, netbanking, or EVC.

- Respond to notices and view communication history from the Income Tax Department.

🎯 Final Thoughts

Registering on the Income Tax e-Filing Portal is the gateway to effortless tax compliance.

It’s secure, digital, and time-saving — empowering every taxpayer to manage taxes independently without long queues or paperwork.

Once you’re registered, filing your ITR takes just a few clicks. So, if you haven’t already, head over to incometax.gov.in and complete your registration today.

Take control of your taxes — because staying compliant is not just mandatory, it’s empowering. 💪