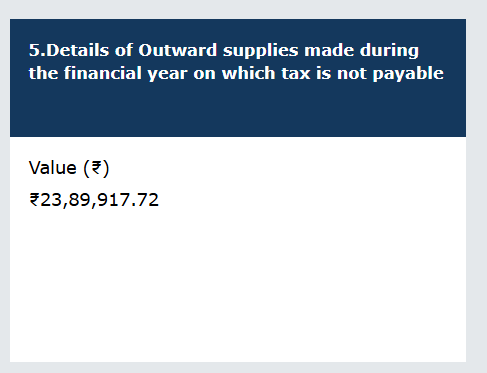

This table is very important because it captures all outward supplies that do not attract GST — i.e., exempted or out-of-scope supplies.

Purpose:

- To report all outward supplies (sales/services) made during the FY on which GST is not payable.

- Helps reconcile books of accounts vs GST returns.

- Provides visibility to the tax authorities on supplies for which no GST was collected.

Scope:

- Domestic supplies only (do not include exports; they go in Table 6A/6B and Table 4C/4D).

- Supplies on which GST is not charged because they are:

- Exempt under GST law

- Out-of-scope of GST

- Nil-rated under GST

1️⃣ What to Include in Table 5

| Type of Supply | Examples | Notes |

|---|---|---|

| Domestic exempt supplies | Education, healthcare, financial services, government services | Fully exempt under GST notifications |

| Out-of-scope supplies | Alcohol for human consumption, petroleum products (if exempted under GST) | Not under GST law |

| Nil-rated goods/services | Supply of goods/services with 0% GST | Include only domestic supplies |

| Services/goods not liable to GST | Certain notified services | Ensure they are not exports |

Important:

- Do not include exports — they have a separate section in Table 6A/6B and Table 4C/4D.

- Do not include taxable supplies or advances — they go in Table 4.

2️⃣ Columns in Table 5

| Column | What to Enter |

|---|---|

| 5A | Description of goods/services |

| 5B | Value of outward supply (taxable value) |

| 5C | Tax rate |

| 5D | Tax amount |

3️⃣ Step-by-Step Guide to Filling Table 5

- Identify all supplies on which GST was not collected:

- Check books of accounts and invoices.

- Exclude exports (use Table 6) and taxable sales (use Table 4).

- Classify supplies by type:

- Exempt supplies (Table 5A: “Education services”)

- Out-of-scope supplies (Table 5A: “Petroleum products”)

- Nil-rated goods/services (Table 5A: “Salt 0% GST”)

- Enter taxable value:

- This is the invoice value excluding GST.

- Tax = ₹0.

- Reconcile with books:

- Ensure total exempt/out-of-scope sales in Table 5 matches books of accounts.

4️⃣ Example of Table 5

| Description of Goods/Services | Taxable Value (₹) | Tax Rate | Tax Amount (₹) | Notes |

|---|---|---|---|---|

| Educational services | 2,00,000 | 0% | 0 | Domestic exempt supply |

| Financial services | 1,50,000 | 0% | 0 | Domestic exempt supply |

| Salt (0% GST) | 50,000 | 0% | 0 | Nil-rated domestic goods |

| Total | 4,00,000 | — | 0 | — |

Total taxable value of exempt/out-of-scope supplies = 4,00,000

5️⃣ Practical Tips & Common Mistakes

| Tip | Explanation |

|---|---|

| Do not include exports | Exports are reported in Table 6A/6B and Table 4C/4D |

| Only domestic exempt or nil-rated supplies | Domestic supplies where GST is not charged |

| Use books for reconciliation | Total in Table 5 must match accounting records |

| Do not include taxable sales or advances | They go in Table 4 (tax payable) |

| Check HSN summary | For audits, HSN-wise breakdown of exempt goods may be required |

6️⃣ Key Takeaways

- Table 5 = Domestic supplies with no GST

- Include:

- Exempt services (education, healthcare, financial)

- Out-of-scope goods/services (alcohol, petroleum if exempted)

- Nil-rated domestic goods/services

- Exclude:

- Exports → Table 6A/6B and 4C/4D

- Taxable sales → Table 4

- Advances → Table 4A/4D

- Tax rate and tax amount = 0

7️⃣ Example Flow for a Business

Suppose a company in FY 2024–25:

| Type | Amount (₹) | Table to Enter |

|---|---|---|

| Domestic taxable sale | 10,00,000 | Table 4A |

| Domestic exempt supply (education) | 2,00,000 | Table 5 |

| Domestic exempt supply (financial services) | 1,50,000 | Table 5 |

| Domestic nil-rated goods (salt) | 50,000 | Table 5 |

| Export (under LUT) | 1,00,000 | Table 4C & Table 6A |

Table 5 captures 2,00,000 + 1,50,000 + 50,000 = 4,00,000

✅ Summary for GSTR-9 Table 5

- Purpose: Show all domestic outward supplies on which GST is not payable.

- Important: Table 5 is only domestic supplies, not exports.

- Key fields: Description, taxable value, tax rate (0%), tax amount (0).

- Check totals with books: Reconciliation is critical for audits.