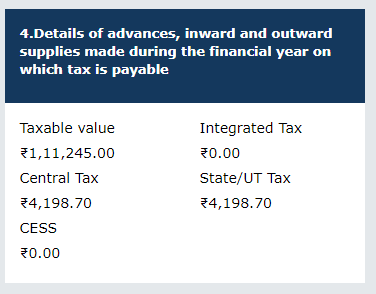

This is one of the most important tables in GSTR-9, as it reconciles all taxable supplies (including advances, outward sales, and inward supplies liable to reverse charge) with the tax actually paid/collected in the financial year.

Purpose:

- To capture all supplies on which GST is payable during the financial year.

- Reconcile GSTR-1, GSTR-3B, and books of accounts.

- Include advances received/adjusted, outward taxable supplies, and inward supplies on which reverse charge applies.

Scope:

- Applies to all taxable supplies (CGST + SGST/UTGST/IGST) within India.

- Excludes:

- Exempt supplies (covered in Table 5)

- Zero-rated exports (covered in 4C/4D)

- Out-of-scope supplies

1️⃣ Sub-sections of Table 4

GSTR-9 Table 4 is divided into four sub-tables (for reconciliation of taxable supplies):

| Sub-table | Description | What to Include |

|---|---|---|

| 4A | Outward taxable supplies (excluding zero-rated & exempt) | Domestic sales on which GST is charged |

| 4B | Outward supplies on which GST is not payable | Domestic exempt/nil-rated (for info, mostly Table 5 covers these) |

| 4C | Zero-rated supplies (exports without payment of tax under LUT/Bond) | Exports under LUT/Bond |

| 4D | Zero-rated supplies (exports with payment of IGST) | Exports on which IGST is paid |

For this tutorial, we focus mainly on taxable supplies, including advances and inward supplies on which tax is payable — i.e., Table 4A (outward), advances, and inward supplies liable to reverse charge.

2️⃣ What Are “Advances” and How to Include Them?

Advances received:

- If you receive advance payment for goods/services during the financial year, you must pay GST on the advance even if goods/services are supplied later.

How to report in GSTR-9 Table 4:

- Column: “Advance received or adjusted”

- Taxable value = value of advance received

- Tax payable = GST calculated on advance

- If advance received in FY but supply made in next FY:

- Include in Table 4 of the FY in which advance is received.

- Adjusted against invoice later — reflected in Table 10 (if necessary).

Example:

- Advance of ₹50,000 received in Dec 2024 for supply in Jan 2025

- GST @18% → ₹9,000

- In Table 4A of FY 2024–25:

- Taxable value = 50,000

- IGST/CGST/SGST = 9,000

3️⃣ Outward Taxable Supplies (Domestic Sales)

- All sales within India on which GST is charged must be included in Table 4A.

- Include:

- Regular sales invoices

- Debit notes increasing taxable value

- Exclude:

- Exports (4C/4D)

- Exempt supplies (Table 5)

Columns in Table 4A (for outward taxable supplies):

| Column | Description |

|---|---|

| Taxable Value | Invoice value of supply excluding GST |

| Integrated Tax (IGST) | IGST charged if inter-state supply |

| Central Tax (CGST) | CGST charged if intra-state supply |

| State/UT Tax (SGST/UTGST) | SGST/UTGST charged if intra-state supply |

| Cess (if applicable) | Compensation cess on goods/services |

Example:

| Invoice | Taxable Value | CGST | SGST | IGST | Notes |

|---|---|---|---|---|---|

| INV001 | 1,00,000 | 9,000 | 9,000 | 0 | Intra-state sale |

| INV002 | 2,00,000 | 0 | 0 | 36,000 | Inter-state sale |

4️⃣ Inward Supplies Liable to Reverse Charge

- If you receive goods/services from unregistered suppliers or specified categories under reverse charge, you are liable to pay GST.

- Must include in Table 4 as “inward supplies on which tax is payable”.

Examples of Reverse Charge:

- Services from a lawyer, advocate, or insurance company

- Goods imported or notified services

How to report:

- Taxable value = invoice value of supply

- Tax payable = IGST/CGST/SGST calculated at applicable rate

- Already claimed as ITC → show ITC separately in Table 8

Example:

| Supplier | Taxable Value | IGST | CGST | SGST | Notes |

|---|---|---|---|---|---|

| Legal Service | 50,000 | 9,000 | 0 | 0 | Reverse charge |

5️⃣ Special Cases

a) Advances received and later adjusted

- If advance is received in one FY but supply made in another FY:

- Include advance in current FY Table 4

- Adjust invoice amount against advance → reflected in Table 10 or future GSTR-9

b) Credit/Debit Notes

- Increases/decreases in taxable value:

- Include positive adjustments in Table 4A

- Negative adjustments reflected in Table 11

c) Export supplies

- Exports (zero-rated) → Table 4C/4D (and Table 6A/6B in GSTR-1)

- Do not include in Table 4A

6️⃣ Step-by-Step Guide to Fill Table 4

- Gather data:

- Monthly/quarterly GSTR-1 invoices

- Advances received

- Debit/credit notes

- Inward supplies liable to reverse charge

- Classify transactions:

- Domestic taxable → Table 4A

- Exports zero-rated → Table 4C/4D

- Exempt/non-GST → Table 5

- Reverse charge → Include taxable value in Table 4A or separate column (if specified)

- Enter taxable value and tax:

- CGST + SGST for intra-state

- IGST for inter-state

- Include advances:

- Value received

- Tax calculated at applicable rate

- Adjust in invoice later

- Reconcile totals:

- Ensure total taxable value matches books

- Ensure total tax matches GSTR-3B

7️⃣ Example of Table 4 (Consolidated)

| Type | Taxable Value | CGST | SGST | IGST | Notes |

|---|---|---|---|---|---|

| Outward intra-state taxable sale | 1,00,000 | 9,000 | 9,000 | 0 | INV001 |

| Outward inter-state taxable sale | 2,00,000 | 0 | 0 | 36,000 | INV002 |

| Advances received | 50,000 | 4,500 | 4,500 | 0 | ADV001 |

| Inward services on reverse charge | 50,000 | 0 | 0 | 9,000 | Legal services |

| Total | 4,00,000 | 13,500 | 13,500 | 45,000 |

Total taxable value = 4,00,000

Total tax payable = 72,000

8️⃣ Practical Tips & Common Mistakes

| Tip | Explanation |

|---|---|

| Do not double count advances | Include once in Table 4; adjust invoices separately |

| Reconcile with GSTR-1 | Ensure all outward taxable invoices are captured |

| Include reverse charge | Include only taxable inward supplies liable to GST |

| Separate exports | Do not include zero-rated exports in Table 4A; use 4C/4D |

| Use credit/debit notes properly | Positive in Table 4; negative in Table 11 |

✅ Key Takeaways

- Table 4 is the backbone of GSTR-9 for taxable supplies.

- Include:

- Outward taxable supplies (intra/inter-state)

- Advances received and adjusted

- Inward supplies under reverse charge

- Exclude:

- Exports (use 4C/4D)

- Domestic exempt supplies (use Table 5)

- Always reconcile with books and GSTR-3B.