Understanding MDR, Platform Fees, GST, Settlement & Common Concerns About High Charges

Paytm Payment Gateway is one of the most widely used online payment systems in India. However, many merchants are often surprised when they review their transaction reports and notice unexpectedly high platform fees, especially for UPI and Credit Card payments.

This guide explains, in simple terms:

- What Paytm charges

- Why the charges may appear high

- How MDR is calculated

- Real examples from live transactions

- How settlement works

- How to reduce or negotiate these fees

- Key questions every merchant must ask Paytm

⭐ 1. Understanding Paytm MDR / Platform Fees

“MDR” (Merchant Discount Rate) or “Platform Fee” is the amount Paytm charges per transaction.

It is deducted automatically before you receive the settlement amount in your bank account.

Paytm charges different MDR for different payment methods:

| Payment Method | Typical MDR Range |

|---|---|

| UPI P2M | 0% – 2% (category dependent) |

| Credit Cards | 1.85% – 4.5% |

| Debit Cards | 0.4% – 1% |

| Wallet | ~1.9% |

| International Cards | 3.5% – 4.5% + GST |

Actual MDR varies depending on:

- Merchant Category Code (MCC)

- Business type (digital services, education, subscriptions, SaaS, etc.)

- Volume of monthly transactions

- Negotiated rates

⭐ 2. Real Example: UPI Payment With High Charges

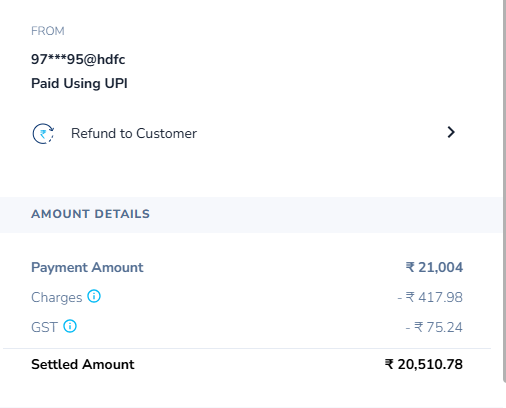

You shared the following live transaction from your dashboard:

UPI Transaction

- Payment Amount: ₹21,004

- Platform Fee: ₹417.98

- Total Charges: ₹417.98

- Settlement: ₹20,510.78

Effective Charge % Calculation

[

\frac{417.98}{21004} \times 100 = 1.99%

]

✅ UPI MDR = ~2%

This is unusually high because UPI P2M is generally known as zero-MDR in India.

However, zero MDR does NOT apply to every business category.

Paytm applies MDR to UPI when the merchant falls under:

- Training & Education

- Consulting

- Digital Services

- Subscription Services

- Online Learning

- High-risk categories (as per banks)

This is likely the reason your UPI MDR is ~2%.

⭐ 3. Real Example: Credit Card Payment With Very High Charges

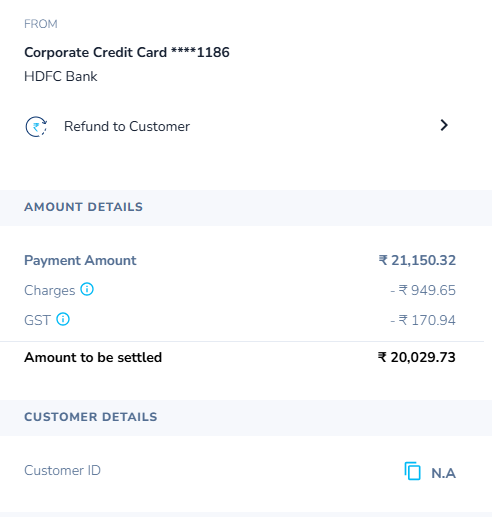

Your second transaction:

Credit Card Transaction

- Payment Amount: ₹21,150.32

- Platform Fee: ₹949.65

- GST on Fee: ₹170.94

- Total Charges: ₹1,120.59

- Final Settlement: ₹20,029.73

Effective Platform Fee %

[

\frac{949.65}{21150.32} \times 100 = 4.48%

]

⚠️ Credit Card MDR ≈ 4.48% (before GST)

This is far above standard domestic MDR.

Such high MDR usually indicates:

- International credit card

- High-risk merchant category

- Higher MCC assigned by default

- No negotiated rates

⭐ 4. Why Are My Paytm Charges So High? (Realistic Explanation)

Your Paytm account is likely categorized under a high-MDR MCC.

Paytm assigns MCC based on:

- Website category

- Business model

- Service type

- Risk/chargeback potential

Your business falls under categories that often attract higher MDR slabs (training, services, consulting, SaaS).

Common reasons for high charges:

✔ 1. Wrong MCC Assigned

A misclassification can instantly push MDR to 3–4.5%.

✔ 2. UPI Zero-MDR Ineligibility

Zero MDR does not apply to many service providers.

✔ 3. No Negotiated Rates

If you haven’t negotiated based on monthly volume, you get default high slabs.

✔ 4. International Card Transactions

These typically charge 3.5%–4.5%.

✔ 5. Digital / Subscription Businesses

These categories are considered higher risk.

⭐ 5. What Is GST on MDR?

GST is charged ONLY on the platform fee, not on the invoice amount.

Example:

Platform Fee = ₹949.65

GST @ 18% = ₹170.94

Total = ₹1,120.59

⭐ 6. Understanding Settlement Amount

Settlement = Payment Amount – Platform Fee – GST

Example:

₹21,150.32 – ₹949.65 – ₹170.94 = ₹20,029.73

Settlement is done:

- Daily

- T+1 to T+2

- Excluding bank holidays

⭐ 7. How to Reduce Paytm Charges — Practical Steps

You can lower your MDR in the following ways:

✔ 1. Request MCC Re-evaluation

Ask Paytm to assign the correct business category.

✔ 2. Negotiate MDR Based on Volume

If your monthly transactions exceed ₹5–10 lakh, Paytm reduces MDR.

✔ 3. Request Lower UPI MDR

UPI should ideally be 0–1% depending on your category.

✔ 4. Enable Link Payments/QR

Some Paytm QR merchants get zero MDR on UPI.

✔ 5. Speak to an Account Manager

Account managers offer revised plans.

⭐ 8. What to Ask Paytm (Very Important)

Every merchant should directly ask:

- What MCC is attached to my account?

- What are the exact MDR slabs for my category?

- Can you shift me to a lower MDR category?

- Can you offer revised MDR based on monthly volume?

- Why is UPI MDR applied at 2%?

- Why is Credit Card MDR >4%?

These questions force Paytm to check your configuration internally.

⭐ 9. Should You Consider Moving to an Alternative?

If MDR stays high, merchants usually compare:

| Provider | UPI MDR | CC MDR |

|---|---|---|

| Razorpay | 0% – 1% | 1.8% – 2.3% |

| Cashfree | 0% – 1% | 1.95% – 2.3% |

| Stripe | N/A | 2.9% + ₹7 |

| Paytm | 0% – 2% | 2% – 4.5% |

If Paytm does not correct your MCC or MDR, switching payment gateways can reduce fees by 40–60%.

⭐ 10. Final Thoughts — Paytm PG Is Good, but MDR Transparency Is Essential

Paytm provides excellent:

- UPI success rates

- Dashboard

- Settlement speed

- Refunding system

But MDR can vary drastically depending on:

- MCC

- Business category

- Negotiation level

- Transaction type

Your real transaction data clearly shows:

- ~2% UPI MDR (higher than normal)

- ~4.5% Credit Card MDR (very high)

This should definitely be reviewed by Paytm.