When it comes to accepting online payments in India, Razorpay is one of the most trusted and widely used payment gateways. Whether you run an e-commerce store, a SaaS business, a mobile app, or even a small service website, Razorpay makes digital payments simple, secure, and seamless.

In this blog, you’ll learn:

- What is Razorpay?

- How Razorpay Works?

- Complete Razorpay Charges for Payment Gateway (Updated)

- Setup Fees, AMC, Payout Charges & Settlement Timeline

- Important Notes About MDR, Technology Fees, & Taxes

⭐ What is Razorpay?

Razorpay is an Indian full-stack payments platform that allows businesses to accept, process, and disburse online payments. It supports 100+ payment modes, including:

- Credit & Debit Cards

- UPI

- Net Banking

- Mobile Wallets

- EMI & Buy Now Pay Later

- International Cards

- Corporate Cards

Razorpay is known for:

- Fast onboarding

- Simple integration (API, Plugins, Mobile SDKs)

- Advanced analytics

- Fraud detection

- High success rates

- Instant settlement options

It is used by lakhs of Indian businesses—from startups to large enterprises.

⭐ How Razorpay Works?

The workflow is extremely simple:

1️⃣ Customer Makes a Payment

The customer selects a payment mode such as UPI, card, net-banking, wallet, etc.

2️⃣ Razorpay Processes the Transaction

Razorpay securely routes the transaction through banks, card networks, and payment systems.

3️⃣ Payment Confirmation

The customer receives success/failure notification instantly.

4️⃣ Money is Settled to Merchant Bank

Razorpay transfers the amount to your business bank account based on the settlement cycle:

- Domestic Settlement: T + 2

- International Settlement: T + 7

(T = Transaction Date)

5️⃣ Monthly Reports & Reconciliation

Razorpay provides:

- Transaction details

- TDS/GST-ready invoices

- Refund dashboards

- Dispute management

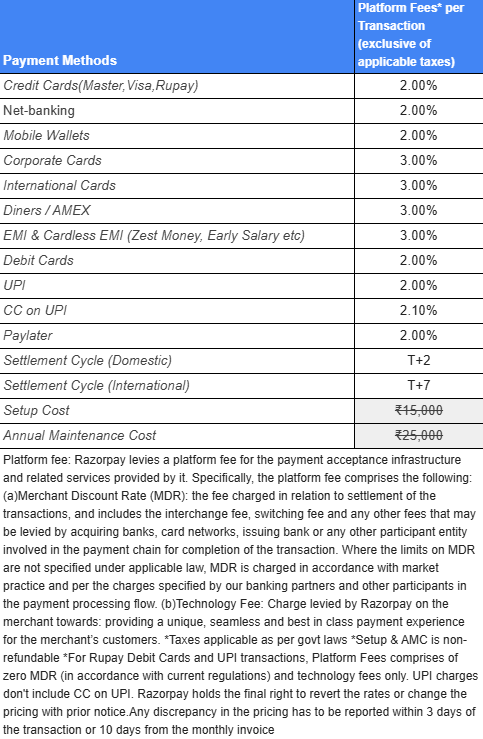

⭐ Razorpay Payment Gateway Charges (Exclusive of Taxes)

(As per your attached document, updated reference copy)

Below are the platform fee percentages for each payment method:

🟦 Razorpay Transaction Charges Table

| Payment Method | Fees per Transaction |

|---|---|

| Credit Cards (Master, Visa, Rupay) | 2.00% |

| Net Banking | 2.00% |

| Mobile Wallets | 2.00% |

| Corporate Cards | 3.00% |

| International Cards | 3.00% |

| Diners / AMEX | 3.00% |

| EMI & Cardless EMI | 3.00% |

| Debit Cards | 2.00% |

| UPI | 2.00% |

| CC on UPI | 2.10% |

| PayLater | 2.00% |

🟦 Settlement Cycles

- Domestic Transactions: T + 2

- International Transactions: T + 7

🟦 Setup Cost

- ₹15,000 (one-time)

🟦 Annual Maintenance Cost (AMC)

- ₹25,000 per year

⭐ Important Notes from Razorpay Terms

Based on the document text:

✔ MDR (Merchant Discount Rate)

MDR includes:

- Interchange fees

- Switching fees

- Bank charges

- Card network charges

Rates can vary depending on market practices.

✔ Technology Fee

Razorpay charges this for:

- Secure payment processing

- Fraud protection

- API infrastructure

- Transaction monitoring

✔ Taxes

GST is applicable as per government rules.

✔ UPI Charges

UPI is free in many cases, but some platforms charge 1–2% for commercial UPI transactions.

✔ Changes in Pricing

Razorpay has the right to revise charges with prior notification.

✔ Discrepancies

Merchants must report transaction fee discrepancies within:

- 3 days of T+10 settlement

or - 10 days from invoice date

⭐ Why Businesses Prefer Razorpay?

- Supports 100+ payment methods

- Best-in-class success rate

- Developer-friendly APIs

- Advanced fraud detection with AI

- Easy refunds and EMI support

- Quick onboarding and intuitive dashboard

- Used by top Indian brands

If you are running an online business, Razorpay gives you simplicity, trust, and scalability from day one.

⭐ Final Thoughts

Razorpay remains the most popular and reliable online payment gateway in India. Whether you’re a freelancer, startup, or enterprise, Razorpay offers:

- Quick integration

- Transparent pricing

- Fast settlements

- High security

- Wide payment mode coverage

Understanding its charges helps you plan better, especially if your business handles a high volume of transactions.