Yes — a business can receive money with Wise. The “how” depends on how your customer will pay:

- If they can pay by bank transfer (local transfer / SWIFT), Wise is built for that and is usually much cheaper.

- If they want to pay by credit/debit card, PayPal is usually the easier option (and in Japan, Wise “get paid by card” isn’t available for businesses).

1) How a BUSINESS receives money with Wise (step-by-step)

A) Open Wise Business + unlock receiving details

- Create a Wise Business account.

- Pay the one-time fee (Japan example: 3,000 JPY) to unlock local account details (bank details in multiple currencies).

- Get your local receiving details (IBAN / account number / routing details depending on currency).

B) Get paid (bank transfer options)

- Local (non-SWIFT / non-wire) receiving: typically free for supported currencies.

- SWIFT / wire receiving (fixed fee per payment): Japan example pricing often shows fixed amounts such as USD wire/SWIFT 6.11 USD, GBP SWIFT 2.16 GBP, EUR SWIFT 2.39 EUR (exact fees vary by region/currency and can change).

C) Collect faster (without “asking for bank details”)

- Create Wise payment links (useful for invoices via email/WhatsApp). Payments still settle via bank rails.

D) Move money to your bank

- Hold balances in multiple currencies, convert only if needed, then transfer to your bank (fees depend on currency + destination).

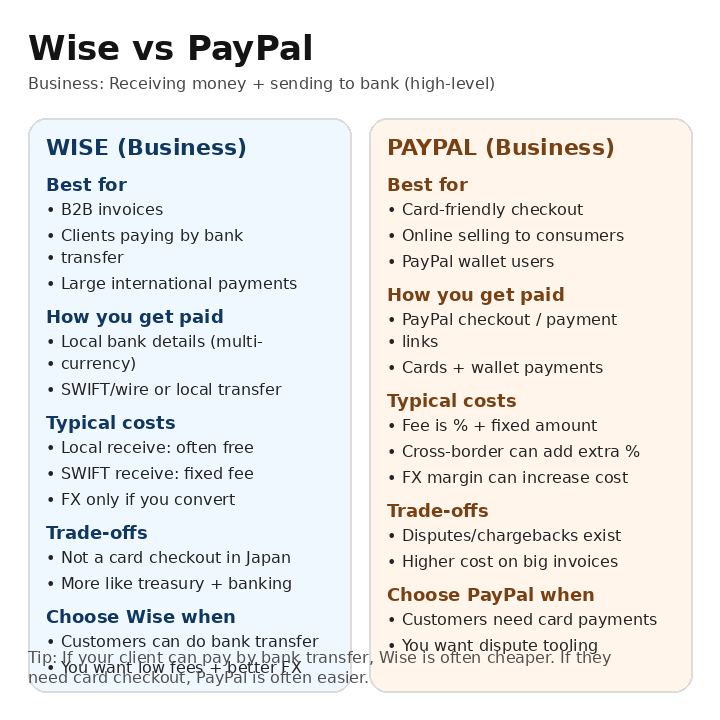

2) PayPal vs Wise — what’s fundamentally different?

- PayPal = a card + wallet checkout system designed for online selling, with disputes/chargebacks and merchant tooling.

- Wise = a multi-currency account + bank transfer rails (local account details + SWIFT/wire), best for B2B invoices and international bank transfers.

3) Feature-by-feature comparison (Business view)

Table 1 — Capabilities & services

| Area | PayPal (Business) | Wise (Business) |

|---|---|---|

| Best for | Card-first payments, e-commerce, global consumers | Bank-transfer payments, B2B invoicing, international clients |

| How customers pay you | PayPal checkout, card via PayPal, payment links/buttons | Bank transfer to local account details; payment links that settle via bank rails |

| “Checkout” experience | Strong (cart/checkout flows, buyer login, etc.) | Not a checkout replacement (bank transfer flow) |

| Disputes & chargebacks | Built-in disputes + chargebacks + seller tools | Bank transfers generally avoid card chargeback mechanics (but bank recalls can exist in limited cases) |

| Multi-currency holding | Yes (PayPal balance currencies vary by region) | Yes (core feature; hold many currencies) |

| Local receiving details | Not a bank account replacement | Yes (local account details in multiple currencies, where available) |

| FX transparency | Often includes an FX margin/markup inside rate | Typically shows explicit conversion fee + rate before confirming |

| Withdraw to bank | Supported; fees/timing depend on country and withdrawal size | Supported; fees depend on currency route and destination |

| Payouts to others | Supported (often with fees/caps) | Strong for vendor/contractor payments; batch payments available |

| Team controls | Role-based access (varies by region/features) | Strong team spend controls + permissions + cards (availability varies) |

| Reporting | Sales/payment reporting, dispute reporting | Transfer + balance reporting, payment reconciliation style |

| Typical “hidden cost” | FX margin + dispute/chargeback fees | SWIFT receiving fee (if you use SWIFT) + conversion fee (only if you convert) |

4) Costs — “at each level” (receiving, FX, withdrawal, disputes)

A) Receiving fees (typical structure)

- PayPal: usually percentage-based merchant fee + fixed fee per transaction. Cross-border often adds an extra percentage.

- Wise: usually free for local receiving (where supported) and fixed fee for SWIFT/wire receiving (per incoming payment).

B) Currency conversion (often the biggest difference)

- PayPal: conversion commonly includes a markup over a base rate (this can materially increase total cost on international receipts).

- Wise: conversion is typically quoted upfront as a fee + rate; you can also avoid conversion by holding the same currency or paying suppliers in that currency.

C) Withdrawal / transfer to your bank

- PayPal (Japan example):

- Withdrawal ≥ 50,000 JPY: often no fee

- Withdrawal < 50,000 JPY: often 250 JPY

- “Instant” withdrawal (if available): often percentage-based

- Wise: bank-out fees depend on route; if you already received in JPY locally, you may simply transfer out without conversion.

D) Disputes / chargebacks

- PayPal: can have chargeback and dispute fees (and you’ll also spend time handling cases).

- Wise: bank transfer payments usually don’t behave like card chargebacks, but reversals/recalls can still happen in some circumstances (far less “consumer checkout” oriented).

Table 2 — Cost components (what you actually pay, by step)

| Cost component | PayPal (Business) | Wise (Business) |

|---|---|---|

| Account setup | Usually no setup fee | Sometimes a one-time fee to unlock local account details (region-dependent; Japan often shown as 3,000 JPY) |

| Receive payment | % fee + fixed fee per transaction | Often free for local receiving; fixed fee for SWIFT/wire receiving |

| Cross-border add-on | Often extra % | Usually not “% add-on” — cost is mainly SWIFT fee (if used) + FX if you convert |

| Currency conversion | FX markup is commonly embedded | Explicit conversion fee shown when converting; can avoid conversion by holding currency |

| Withdraw/transfer to bank | Fees vary by country/amount; may be free above threshold | Transfer fee varies by route; often straightforward bank transfer pricing |

| Disputes/chargebacks | Possible extra dispute/chargeback fees | Generally not a card-chargeback system (bank rails differ) |

| Operational overhead | Dispute handling, buyer messaging, evidence submission | More like treasury + banking ops (reconciliation, invoices, transfers) |

5) Real-world scenario cost examples (Japan-based illustration)

Example 1: You invoice a Japanese client ¥100,000

- PayPal: If treated as a commercial card/wallet payment, you may pay around 3.60% + ¥40 = ¥3,640 (example structure; verify your exact rate).

- Wise: If client pays by local bank transfer, your “receive” fee is often ¥0 on the Wise side (client’s bank may charge them).

Example 2: You invoice a US client $10,000 and they can pay by wire

- PayPal: If processed as a commercial international payment, fees can be roughly 4.10% + fixed fee (and FX conversion, if any, can add more cost).

- Wise: If received as USD wire/SWIFT, you may pay a fixed receiving fee (Japan example often shown around $6.11), plus conversion fee only if/when you convert to JPY.

These examples show why Wise tends to win on invoice + bank transfer workflows, while PayPal wins on card checkout convenience.

6) Quick decision table (what to use when)

Table 3 — Best fit by business model

| Your situation | Better choice | Why |

|---|---|---|

| B2B invoices, clients can pay by bank transfer | Wise | Lowest receiving costs; easy multi-currency; better FX control |

| International clients paying large amounts | Wise | Fixed receiving + optional conversion often beats % fees |

| You sell to consumers who want card checkout | PayPal | Customer convenience + built-in dispute/chargeback flows |

| You need a “Buy now / Pay with card” checkout button | PayPal | Wise isn’t a checkout replacement (bank rails vs card checkout) |

| You pay contractors/vendors in many countries | Wise | Efficient international payouts; batch payments; multi-currency treasury |

| High chargeback/dispute risk products | Depends | PayPal has formal tooling; Wise avoids card rails but isn’t consumer-checkout oriented |

I