Here is a comparative table summarizing credit card usage and penetration rates for 2025 in India, China, Japan, and the USA, based on the latest available data:

| Country | % Using Credit Cards | % Owning Credit Cards / Penetration | Notes |

|---|---|---|---|

| India | 5–6% | 5–6% | Low usage; mostly urban, card count ≈ 111 million; UPI and debit cards more popular |

| China | Not specified (ownership used as proxy) | 38% | 767 million+ cards; most transactions via mobile payments; usage lower than ownership |

| Japan | 78% | 84% | Credit cards are the leading cashless method; 80%+ of cashless transaction value |

| USA | 35% of all transactions, 82% of adults own | 82% | 827+ million cards; very high ownership; average 4 cards/holder |

- India: Credit card penetration remains at 5–6% of the total population, with most usage in cities. Growth is rapid but still limited to a minority.

- China: About 38% of adults aged 15+ own a credit card; active, regular usage is a smaller subset due to the dominance of WeChat Pay and Alipay.

- Japan: Credit card usage rate is 78% and ownership is 84%, making it the top non-cash payment method.

- USA: 82% of adults report having a credit card; credit cards account for 31–35% of all payment transactions, highest among these countries.

Here is a detailed overview of the top credit card issuers in India in 2025, with their approximate market shares and most popular card offerings:

Top Credit Card Issuers & Market Shares (India, 2025)

| Bank | Market Share | Notable Card Offerings | Key Notes |

|---|---|---|---|

| HDFC Bank | 22% | Infinia, Regalia, Diners Club Black, Tata Neu Infinity | Consistently the largest issuer; strong premium & co-branded cards; major issuer in metros and Tier-2/3 cities |

| SBI Card | 19% | SBI Cashback, SBI Card Elite, SimplyCLICK | Backed by SBI reach; strong growth in rural/urban segments, second largest issuer |

| ICICI Bank | 16% | Amazon Pay ICICI, Coral, Rubyx | Aggressive co-branding (Amazon, HPCL); strong retail/online presence |

| Axis Bank | 14% | Reserve, Atlas, MyZone, Ace | Gained urban market post Citi acquisition; popular for travel, entertainment cards |

| Kotak Mahindra Bank | 4-5% | White Reserve, Essentia | Strong focus on digital and fintech partnerships; smaller, but growing segment |

| RBL Bank | ~3% | RBL Platinum Maxima | Specialized cards, smaller market share, focus on lifestyle/urban users |

| Others (incl. IndusInd, IDFC First, Amex, BOB) | <10% | Assorted niche and co-branded cards | Growing steady, especially with co-branded and digital-first cards |

- Total market is dominated (~71%) by private sector banks; public sector (except SBI) are less prominent.

- 111 million+ cards are in circulation as of May 2025, with HDFC Bank, SBI Card, ICICI Bank, and Axis Bank together holding over 3/4th of all issued cards.

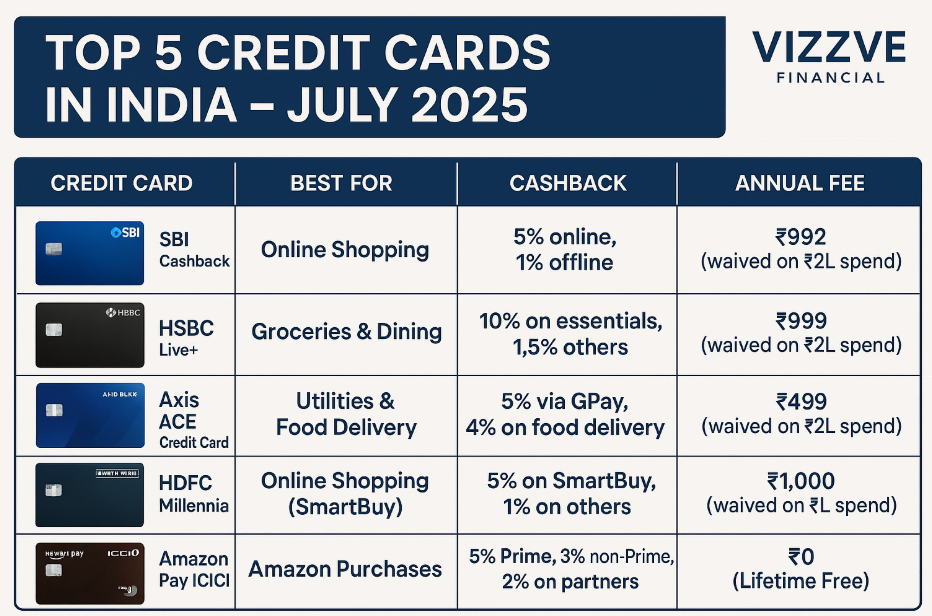

Most Popular Cards by Usage/Preference

- HDFC Infinia, Regalia, Diners Club Black: Premium travel/rewards cards, popular among affluent users.

- SBI Cashback, SimplyCLICK, Card Elite: Rewards and ecommerce-focused cards, widely adopted.

- Amazon Pay ICICI Credit Card: Co-branded retail card, lifetime free, extremely popular for online shoppers.

- Axis Bank Ace, MyZone: Cash back and entertainment cards with high urban adoption.

- Co-branded cards (Tata Neu-HDFC, Flipkart-Axis, etc.): Rapid growth due to strong partnerships and e-commerce integration.

Key Trends

- Co-branded cards (with Amazon, Tata, Flipkart, Swiggy, etc.) are driving rapid user adoption and have become a major growth segment.

- Majority of new issuance and spends (~85%) are driven by digital/online transactions.

- Tier 2 & 3 cities are increasingly contributing to market growth, not just metros.

- UPI-linked RuPay credit cards are growing but still hold a smaller market share compared to Visa/Mastercard.

Summary:

HDFC Bank leads with a 22% share, followed by SBI Card (19%), ICICI Bank (16%), and Axis Bank (14%). Most popular offerings are HDFC’s Infinia/Regalia, SBI Cashback/Elite, ICICI Amazon Pay, and Axis Ace/Reserve cards. Private banks collectively dominate the market and co-branded cards are the fastest growing segment.

Credit card company listed

The only pure-play credit card company listed on the Indian stock markets (NSE and BSE) is SBI Cards and Payment Services Limited (traded as SBICARD on NSE and BSE). SBI Cards is India’s second-largest credit card issuer by market share, but it is the only company in India exclusively focused on credit card issuance that is publicly listed.

Other major credit card issuers in India—such as HDFC Bank, ICICI Bank, and Axis Bank—are also listed on NSE and BSE, but their primary business includes a broad range of retail and corporate banking services, not just credit cards. Their credit card operations are part of their larger business, and they do not have stand-alone, separately listed credit card subsidiaries.

- Listed Pure-Play Credit Card Company:

- SBI Cards and Payment Services Ltd.

- NSE symbol: SBICARD

- BSE code: 543066

- SBI Cards and Payment Services Ltd.

- Banks with Large Credit Card Operations:

- HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank (all listed, but credit cards are part of their overall banking operations, not stand-alone listed subsidiaries).

Summary:

If you are looking for a company whose main business is credit card issuing and is listed on NSE and BSE in India, SBI Cards and Payment Services Ltd. is the only such company as of August 2025. All other credit card issuers operate under their respective banking licenses and are not separately listed as credit card companies.

Why SBI Cards Share Price is Not Growing: Analysis (2025)

Despite steady business growth and sector leadership, SBI Cards’ share price has shown muted performance in 2025. The stock’s price is in the range of ₹690–930 (August 2025), up about 14% over one year but delivering a flat 5-year CAGR and underperforming compared to peers and market expectations. Below is a structured review of contributing factors, a complete SWOT analysis, and key financial/market parameters.

Recent Performance & Key Share Price Factors

- Revenue Growth but Profit Under Pressure: Q1 FY25 saw revenue rise 12% YoY to ₹5,035cr, but net profit fell 6% YoY to ₹556cr due to higher operating costs and muted margins.

- Rising Asset Quality Concerns: GNPA ratio is stable (~3.1%), but return ratios have declined (ROAE fell to 15.8% from 19.1% YoY), pointing to tightening profitability.

- Market Sentiment: The stock is viewed as range-bound due to competitive pressure, return compression, and moderate growth outlook, despite sector tailwinds and growing credit card adoption in India.

SWOT Analysis (2025)

| Strengths | Weaknesses |

|---|---|

| – Strong SBI brand and largest pure-play card issuer in India (19%+ market share) | – Stock has underperformed sector and peer indices |

| – Diversified card portfolio, robust reach (Tier-1/2/3 cities) | – Revenue and cash flow are India-centric; no international diversification |

| – Solid parental support (SBI), high customer trust | – Vulnerable to interest rate cycles and economic slowdowns |

| – Growing operating income and expanding card base (CAGR ~10%) | – High cost-to-income ratio (~50–66%) |

| – Good asset quality control, improving digital platforms | – Rising competition pressure squeezes yield and margins |

| Opportunities | Threats |

|---|---|

| – Rapid digitalization and rising credit card adoption in semi-urban/rural India | – Intense competition from private banks, fintechs, and global players |

| – Product & tech innovation (UPI-linked cards, digital EMIs) | – Regulatory changes (interest rate caps, MDR regulations, data privacy laws) |

| – Cross-selling through SBI ecosystem | – Cybersecurity risks and rising default risk in unsecured lending |

| – Expansion via co-branded cards with e-commerce/retail brands | – Economic downturns impacting credit demand and repayment |

Key Financial and Market Parameters (2025)

| Parameter | Value/Trend | Notes |

|---|---|---|

| Market Cap | ~₹72,000cr | |

| Revenue (Q1 FY25) | ₹5,035cr | +12% YoY |

| Net Profit (Q1 FY25) | ₹556cr | -6% YoY |

| Cards in Force | 2.12cr | +10% YoY |

| Spends Market Share | 16.6% | Up YoY |

| GNPA | 3.07% | Improved slightly Q/Q |

| ROE (TTM) | ~15.8–20% | Declining trend |

| Share Price Range | ₹690–930 | (Aug 2025) |

| Cost-to-Income | 50–66% | Higher than peer avg. |

| PE Ratio | ~27 |

Why Isn’t the Share Price Growing Faster?

- Profitability pressures: Margins have compressed due to increased operating costs, higher provisioning/write-offs, and competitive yield pressures.

- Asset quality vigilance: Concerns over unsecured credit growth and rising delinquencies (esp. post-COVID) have spooked the market.

- Competitive and Regulatory Headwinds: Rising competition from fintechs and regulatory vigilance on charges/yields have capped bullish sentiment.

- High Expectations Priced In: Prior valuations reflected optimistic growth, so current modest gains reflect normalization and risk pricing.

- Limited Diversification: Heavy dependence on domestic (India-only) consumer credit exposes it to macro shocks more than diversified banks/NBFCs.

Conclusion

SBI Cards remains a sector leader with solid fundamentals, but its share price growth in 2025 is tempered by profitability pressures, elevated competition, and market concerns about unsecured credit quality. The stock’s future upside is linked to margin improvement, innovation, and deeper penetration into India’s untapped market segments.

Investors eyeing SBI Cards should weigh its robust market presence, growth opportunity, and strong parental backing against its rising costs, regulatory headwinds, and the realities of operating in an increasingly competitive and closely watched market.