Benefits of “For 60+ years, regular income with tax benefits”

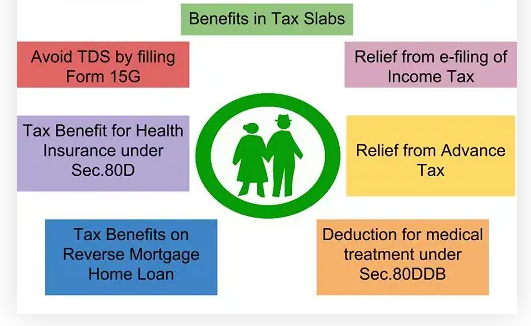

- Higher Tax Exemption Limits: Senior citizens enjoy higher basic exemption limits compared to non-seniors. For FY 2025-26, income up to ₹3 lakh is tax-free for those aged 60-79, and up to ₹5 lakh for those 80+ under the old regime.

- Section 80TTB Deduction: Deduction of up to ₹50,000 per annum on interest income from savings accounts, FDs, and recurring deposits.

- Section 80D Deduction: Higher deduction up to ₹50,000 on health insurance premiums paid.

- No Advance Tax: Senior citizens without business income are exempt from paying advance tax.

- Standard Deduction: ₹50,000 deduction on pension or salary income.

- Tax-Saving Investment Options: Many investment plans offer both regular income and tax deductions under Section 80C or other sections.

Risks of “For 60+ years, regular income with tax benefits”

- Interest Rate Risk: Returns from fixed-income products like FDs and SCSS are subject to change as rates are revised periodically.

- Inflation Risk: Fixed returns may not keep pace with inflation, reducing purchasing power over time.

- Liquidity Constraints: Some schemes have lock-in periods or penalties for premature withdrawal (e.g., SCSS, Tax-saving FDs).

- Taxation on Returns: While some investments offer tax deductions, the interest or returns may still be taxable beyond certain limits.

- Market Risk: Equity-linked products (like ELSS) carry market risks, which may not suit all seniors.

Top 10 Plans for Regular Income with Tax Benefits (2025)

| Plan Name | Type | Key Tax Benefit | Pros | Cons |

|---|---|---|---|---|

| Senior Citizen Savings Scheme (SCSS) | Govt. Savings | 80C deduction | High safety, regular income, 5-yr lock-in | Interest taxable, premature penalty |

| Post Office Monthly Income Scheme (POMIS) | Govt. Savings | No 80C, but regular income | Steady monthly payout, low risk | No 80C, interest taxable, 5-yr lock-in |

| Tax-Saving Fixed Deposits (FDs) | Bank FD | 80C deduction | Low risk, fixed returns | 5-yr lock-in, interest taxable |

| Pradhan Mantri Vaya Vandana Yojana (PMVVY) | Govt. Pension | Pension income | Assured pension, 10-yr term, safe | Purchase limit, returns taxable |

| National Pension System (NPS) | Pension/Market | 80C & 80CCD(1B) | Tax benefit, partial lump sum tax-free | Market risk, partial annuity mandatory |

| Monthly Income Plans (MIPs) – Mutual Funds | Mutual Fund | LTCG tax benefit | Potential for higher returns, monthly payout | Market risk, returns not guaranteed |

| Tax-Free Bonds | Govt. Bonds | Tax-free interest | No tax on interest, safe | Lower returns, limited availability |

| Public Provident Fund (PPF) | Govt. Savings | 80C deduction, tax-free | Safe, EEE status, 15-yr lock-in | Long lock-in, no regular income |

| Life Insurance Pension Plans | Insurance | 80C deduction | Regular annuity, life cover | Returns taxable, surrender charges |

| Equity Linked Savings Scheme (ELSS) | Mutual Fund | 80C deduction | Shortest lock-in (3 yrs), high return potential | Market risk, returns not guaranteed |

Comparison Table: Pros & Cons

| Plan Name | Pros | Cons |

|---|---|---|

| Senior Citizen Savings Scheme | High safety, regular income, 80C benefit, easy to open | Interest taxable, 5-yr lock-in, premature withdrawal penalty |

| Post Office MIS | Safe, steady monthly income, simple | No 80C benefit, interest taxable, 5-yr lock-in |

| Tax-Saving Fixed Deposits | Fixed returns, 80C benefit, low risk | 5-yr lock-in, interest taxable, lower than inflation |

| Pradhan Mantri Vaya Vandana Yojana | Assured pension, government-backed, 10-yr term | Purchase limit, returns taxable |

| National Pension System | Additional 80CCD(1B) benefit, partial lump sum tax-free | Market risk, annuity purchase mandatory |

| Mutual Fund MIPs | Potential for higher returns, monthly payout | Market risk, returns not assured |

| Tax-Free Bonds | Tax-free interest, safe, long tenure | Lower returns, limited issues |

| Public Provident Fund | Safe, EEE tax status, 80C benefit | 15-yr lock-in, no regular income |

| Life Insurance Pension Plans | Regular annuity, life cover, 80C benefit | Returns taxable, surrender charges |

| ELSS Mutual Funds | Shortest lock-in, high return potential, 80C benefit | Market risk, returns not guaranteed |

Frequently Asked Questions (FAQ)

Who qualifies as a senior citizen for tax purposes?

Anyone aged 60 years or above during the financial year. Super senior citizens are 80 years or above.

What is the income tax exemption limit for senior citizens?

For FY 2025-26, up to ₹3 lakh for 60–79 years and up to ₹5 lakh for 80+ years under the old regime.

What are the main tax deductions available?

- Section 80C (up to ₹1.5 lakh for investments like SCSS, FDs, ELSS)

- Section 80TTB (up to ₹50,000 on interest income)

- Section 80D (up to ₹50,000 for health insurance)

Is the interest from SCSS taxable?

Yes, interest is taxable, but the investment qualifies for 80C deduction.

Can NRIs avail these senior citizen benefits?

No, most benefits are for resident senior citizens only.

Are there any plans with tax-free returns?

Tax-free bonds offer tax-free interest; PPF offers tax-free maturity but no regular income.

Is premature withdrawal allowed?

Some plans allow it with penalties (e.g., SCSS, FDs), while others like PPF have strict lock-ins.

Can I invest in multiple schemes simultaneously?

Yes, subject to individual scheme limits.