Under the Indian Goods and Services Tax (GST) regime, credit notes play a critical role in correcting invoice values and tax liabilities post the original supply. However, a common misconception among many taxpayers and professionals is that to claim deductions or adjustments for credit notes in GST returns, it is mandatory to obtain a certificate from a Chartered Accountant (CA) or Cost and Management Accountant (CMA).

This blog aims to clarify this misunderstanding with detailed explanations on:

- What exactly are credit notes under GST?

- When and how credit notes are issued and adjusted.

- Whether a CA/CMA certificate is required for claiming credit note deductions.

- The legal provisions and GST circulars related to credit notes.

- Practical steps and best practices to claim credit note deductions.

- Exceptional scenarios where CA/CMA certificates may be needed.

What is a Credit Note in GST?

A Credit Note (CN) is a document issued by a supplier to the recipient in the following scenarios:

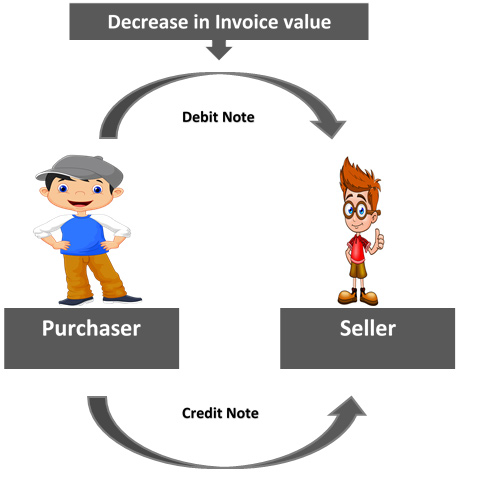

- When the value of goods or services supplied decreases after the issuance of the original invoice.

- If goods are returned or services are canceled.

- To pass on post-invoice discounts or rebates.

- To correct any errors related to value, quantity, or tax charged on the original invoice.

Purpose:

The credit note reduces the taxable value or tax liability declared earlier and allows the recipient to claim a corresponding reduction in Input Tax Credit (ITC) or tax liability.

How are Credit Notes Reported and Adjusted in GST Returns?

- Supplier’s Responsibility:

- The supplier must report details of the credit note in their monthly GSTR-1 return in the tax period in which the credit note is issued.

- The credit note details reduce the outward taxable supplies for that period.

- Recipient’s Responsibility:

- The recipient adjusts the ITC or tax liability in their GSTR-3B return for the same or a subsequent tax period.

- The credit note adjustment reduces the ITC claimed or tax liability proportionally.

Is CA/CMA Certificate Mandatory to Claim Deduction of Credit Notes?

Official Position:

No provision in the GST law mandates obtaining a CA/CMA certificate to claim deductions arising out of credit notes.

Why This Myth Exists?

- Some professionals or taxpayers may believe a certificate is needed due to complexities involved in reconciliation and audits.

- In specific cases like special audits, refund claims, or dispute resolutions, certificates from professionals might be requested or helpful.

- Companies may impose internal control procedures requiring CA certification for large or significant credit note adjustments, but these are internal policies, not statutory requirements.

Legal Framework and GST Provisions

- CGST Act, 2017:

No clause requires certification for credit note adjustments. - GST Rules:

Credit note details must be reported in Form GSTR-1 by suppliers and then reflected in recipients’ GSTR-3B. - CBIC Circulars and Notifications:

No circular has mandated a CA/CMA certificate for routine credit note deductions. - GST Portal Functionality:

There is no facility to upload or attach any professional certificate when filing returns.

When is CA/CMA Certification Required?

While not mandatory for credit notes, CA/CMA certificates may be necessary in some scenarios:

1. Special Audit (Section 66 of CGST Act):

If tax authorities order a special audit, the auditor (CA/CMA) will examine all records, including credit notes. The auditor submits a certified report, which acts like a professional certification.

2. Refund Claims for Inverted Duty Structure (Rule 89(5) of CGST Rules):

Refund claims related to accumulated ITC in inverted duty situations require a certificate from a CA or CMA certifying the accuracy of the claim, which may include credit note adjustments.

3. Dispute Resolution & Assessment:

During GST audits, assessments, or disputes, the taxpayer may submit CA/CMA certified reconciliation statements or audit reports validating credit note claims.

4. Internal Compliance Controls:

Some large organizations voluntarily require professional certification as part of their internal audit and control framework.

How to Properly Claim Credit Note Deduction in GST Returns?

Step 1: Obtain a Valid Credit Note

- Ensure the supplier issues a proper GST-compliant credit note containing all mandatory details such as invoice number, date, GSTIN, value, and tax amount.

Step 2: Verify Supplier’s Filing

- Confirm that the supplier has declared the credit note in their GSTR-1 for the month in which the credit note was issued.

Step 3: Adjust ITC/Tax Liability in Your GSTR-3B

- Adjust the credit note value and corresponding tax in your GSTR-3B for the month of receipt or subsequent months.

Step 4: Maintain Documentation

- Keep the original credit note, invoice, and related correspondence securely for audit and verification purposes.

Step 5: Reconcile Regularly

- Regularly reconcile your purchase register with GSTR-2A/2B and supplier declarations to ensure all credit notes and invoices are properly accounted for.

Consequences of Incorrect Credit Note Adjustments

- Claiming ITC without a valid credit note or supplier declaration may lead to GST demand, interest, and penalties.

- Incorrect filing may trigger notices or audits.

- Lack of documentary evidence can weaken your position in disputes.

Best Practices for Taxpayers

- Do not rely on CA/CMA certificates unless specifically required.

- Focus on maintaining complete and accurate documentary evidence.

- Regularly reconcile GST returns and supplier invoices.

- Consult a GST practitioner or tax consultant if you face complex credit note scenarios or disputes.

- Stay updated with GST notifications and circulars.

Summary Table

| Aspect | Requirement | Comments |

|---|---|---|

| CA/CMA certificate for CN | Not required under GST law | Only for special audits, refunds, etc. |

| Document needed | Valid credit note + invoice | Mandatory for claim |

| Reporting | Supplier in GSTR-1, Recipient in GSTR-3B | Monthly filing |

| Audit / Assessment | CA/CMA certificate may be required | If ordered by GST authorities |

| Internal controls | Company policy may require | Not statutory |

Final Thoughts

The mandatory CA/CMA certificate requirement for claiming credit note deductions under GST is a misconception. Taxpayers should focus on compliance with filing and documentation norms. Professional certification is only required in exceptional or specific cases such as special audits or certain refund claims.

Proper documentation, timely filing, and regular reconciliation remain the best safeguards against GST scrutiny related to credit notes.

Frequently Asked Questions (FAQs)

Q1. Can I claim ITC for a credit note without CA/CMA certification?

Yes, as long as you have a valid credit note and the supplier has reported it.

Q2. Does the GST portal require uploading CA/CMA certificates for credit note adjustments?

No, the GST portal does not require any such document uploads.

Q3. When should I get a CA/CMA certificate for GST matters?

Mostly during special audits, inverted duty refunds, or tax assessments if asked by authorities.

Q4. What if my supplier has not filed the credit note in their GSTR-1?

You should not claim ITC or adjustment until the supplier files the credit note properly.

Stay Updated!

GST laws are subject to changes and new notifications. Always follow official updates from:

- CBIC Website: cbic.gov.in

- GST Portal: gst.gov.in

- GST Council announcements