Hey all,

Today, I will let you know how to resolve the system-generated error of System Checking on Compliance for Form DRC-01C” Error on the GST Portal and why this error has happened.

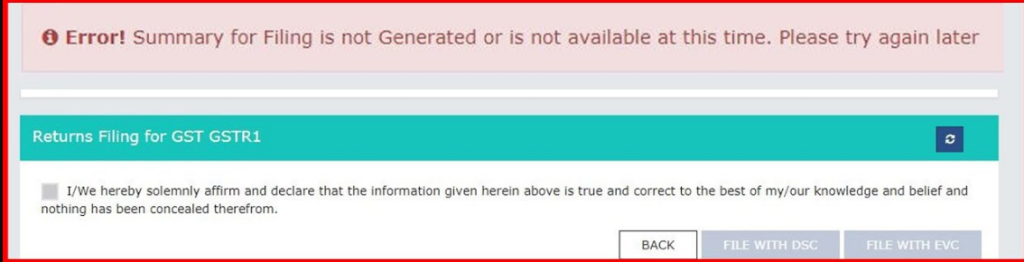

Encountering errors while filing GST returns can be a daunting experience, especially when the message displayed is as cryptic as “System checking on compliance for form DRC-01C. Please try to file GSTR-1 again after some time.” In this article, we’ll break down the reasons behind this error, guide you on how to fix it and provide steps for successfully filing GSTR-1 after resolving the issue.

Why is this error showing?

The error message appears when the GST Portal is conducting a compliance check related to Form DRC-01C. This form serves as an intimation sent to taxpayers when discrepancies are found between the Input Tax Credit (ITC) claimed in GSTR-3B and the ITC available in GSTR-1.

Here are some common reasons for this error:

- Discrepancies in ITC: You might have claimed more ITC in GSTR-3B than what is available in GSTR-1.

- Missed Invoices: Some invoices might have been missed in GSTR-1 reporting.

- ITC Entry Errors: Errors in entering ITC details in GSTR-1 can lead to this issue.

- Cancelled Invoices: Cancelling invoices that were previously claimed for ITC can trigger this error.

How to fix this error:

To resolve this error, follow these steps:

- Reconcile ITC Records:

- Download your GSTR-2A & 2B report from the GST Portal.

- Review the report for discrepancies between the ITC reported by suppliers and the ITC claimed in GSTR-3B.

- Investigate and correct any discrepancies in your records.

- File a Reply in Form DRC-01C:

- Log in to the GST Portal.

- Go to ‘Returns’ > ‘Reply to Intimation’.

- Select Form DRC-01C and provide the necessary information.

- Submit the form after filing your reply.

How to file GSTR-1 after resolving the error:

Once you’ve filed the reply in Form DRC-01C and resolved the discrepancy, follow these steps to file GSTR-1:

- Log in to the GST Portal.

- Go to ‘Returns’ > ‘File Return’.

- Select Form GSTR-1 and enter the required information.

- Review the details and submit the form.

Tips to Avoid Future Errors:

- Regular Reconciliation: Reconcile ITC records regularly to ensure accuracy.

- Thorough Review: Carefully review your GSTR-2A report before filing GSTR-3B.

- Accurate Data Entry: Enter ITC details correctly in GSTR-1 to prevent errors.

- Manage Cancelled Invoices: Keep track of canceled invoices and reverse claimed ITC in GSTR-

By following these steps and staying vigilant about your data, you can resolve the “System Checking on Compliance for Form DRC-01C” error and file your GST returns smoothly, ensuring compliance and seamless business operations.

Thanks,

Note Point***

You will get help from this Government newsletter for the conclusion.