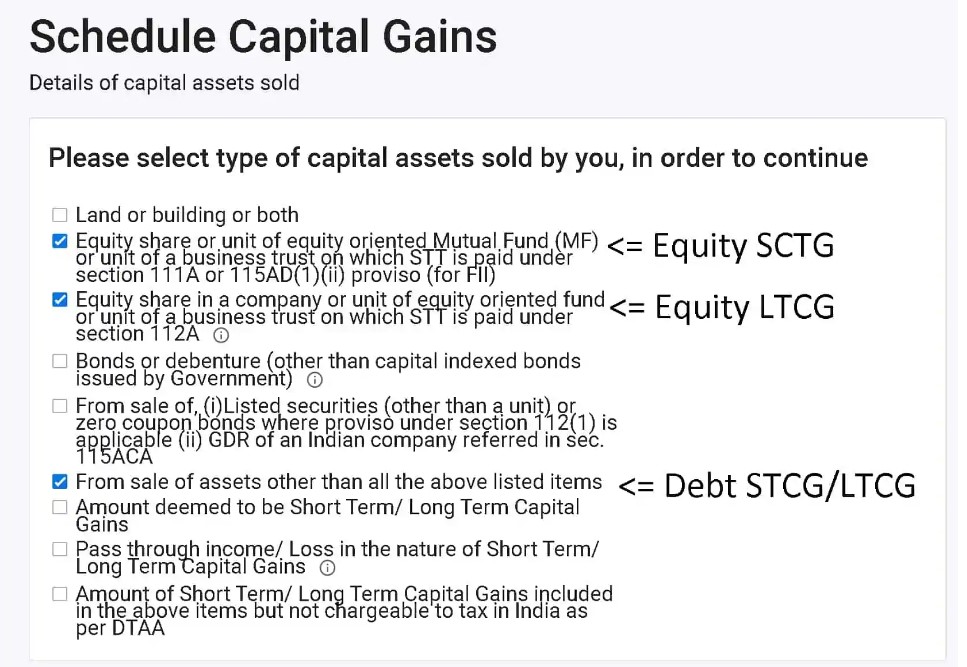

When you click on schedule CG, you will get this checklist.

Schedule Capital Gains checklist in ITR2 and ITR3

If you have short-term capital gains from shares and equity mfs, select “Equity share or unit of equity oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A or 115AD(1)(ii) proviso (for FII)”.

If you have long-term capital gains from shares and equity mfs, select “Equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A”.

If you have short or long-term capital gains from non-equity mutual funds (debt funds, FOFs, international funds, gold funds) select “From the sale of assets other than all the above-listed items”. Hit continue.

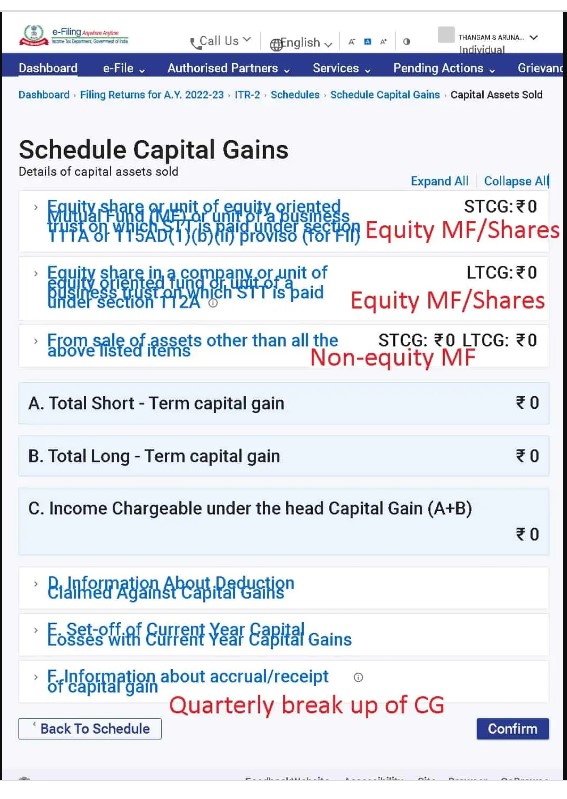

This is how the CG schedule will look before it is filled. The blocks annotated in red need to be filled.

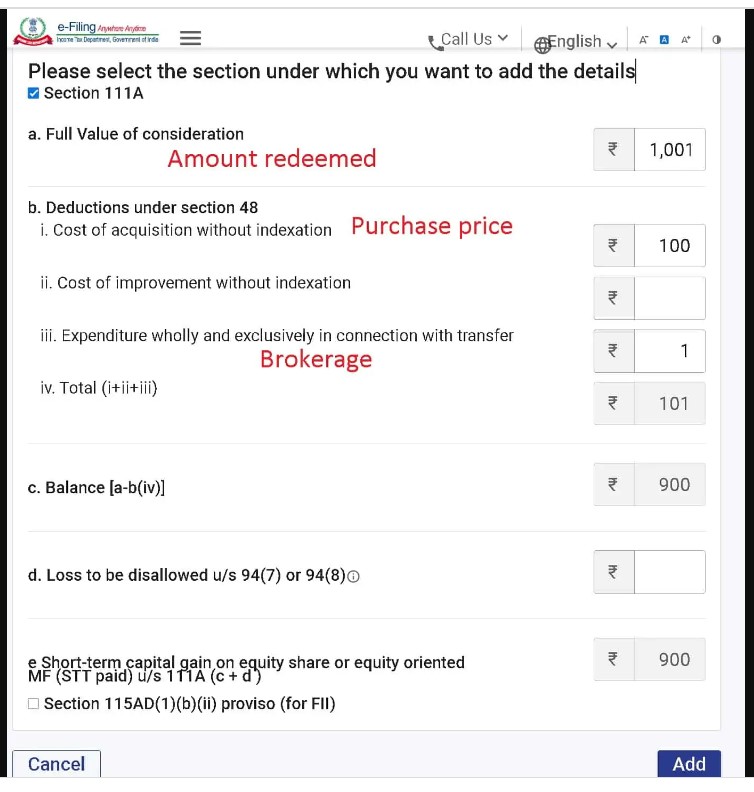

Entering STCG from Equity MF/Shares

(1) Let us start with Equity MF/Share STCG. Select section 111A to proceed.

- Full value of consideration = Redeemed Amount

- Cost of acquisition = Purchase price

- Indexation = Increasing the purchase price using the cost inflation index. This is applicable only for Non-equity LTCG. Hence “Cost of acquisition without indexation” here.

- Expenditure incurred wholly and exclusively in connection with transfer (brokerage)

- The above meanings are universal and will be used for types of capital gains.

A simple example is shown below. You will need to get these numbers from the capital gains statement. We will look at a complex example in the next article.

You will need to repeat this process for each STCG entry.

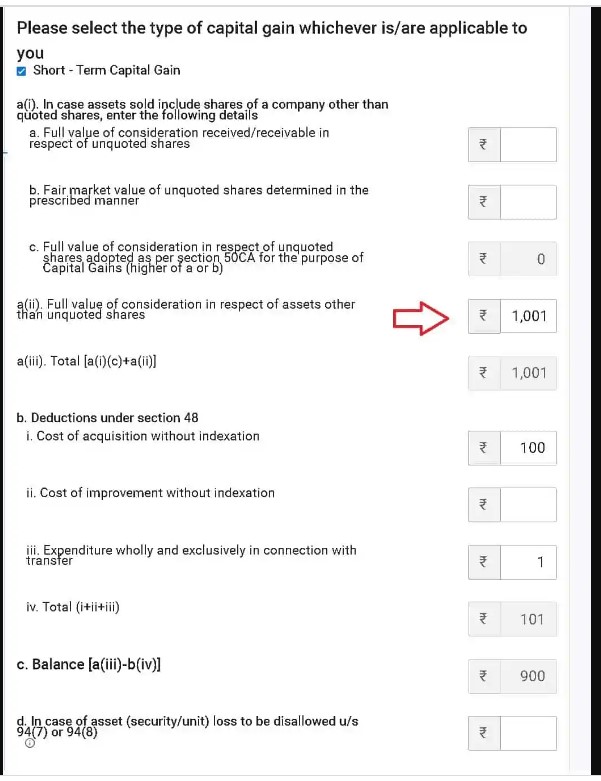

Entering STCG and LTCG from Non-Equity MF/Shares

(2) Next we will consider STCG or LTCG from non-equity MFs as that is simpler to handle.

(a) STCG from non-equity MFs

The meanings of the entries are as above. The full value of consideration should be entered in the place marked by the red arrow.

d- https://freefincal.com/how-to-enter-mutual-fund-and-share-capital-gains-in-itr2-or-itr3/