1. What is Retirement Benefit for Salaried Employees?

Retirement benefits for salaried employees refer to the financial benefits and security provided to employees after they retire from active employment. These benefits ensure a steady income or financial support during post-retirement life, helping employees maintain their standard of living when their regular salary ceases.

2. Benefits of Retirement Benefits for Salaried Employees

- Financial Security: Provides a source of income after retirement.

- Tax Benefits: Many retirement plans offer tax deductions and exemptions.

- Peace of Mind: Reduces financial worries in old age.

- Encourages Savings: Helps inculcate disciplined savings habits.

- Inflation Protection: Some plans offer inflation-adjusted payouts.

- Employer Contributions: Some plans have employer matching, boosting corpus.

3. Risks Associated with Retirement Benefits for Salaried Employees

- Market Risk: Investments tied to equity or mutual funds may fluctuate.

- Inflation Risk: Fixed payouts may lose value over time.

- Longevity Risk: Outliving retirement corpus.

- Liquidity Risk: Some plans have lock-in periods or penalties for early withdrawal.

- Interest Rate Risk: For fixed-income plans, changes in interest rates affect returns.

- Regulatory Risk: Changes in government rules may impact benefits or taxation.

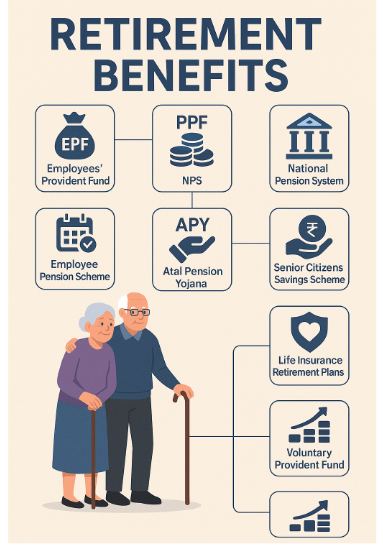

4. Top 10 Retirement Benefit Plans for Salaried Employees in India

| Plan Name | Type | Description | Pros | Cons |

|---|---|---|---|---|

| 1. Employees’ Provident Fund (EPF) | Provident Fund | Mandatory savings with employer contribution, offers interest. | Tax benefits, employer contribution, steady returns | Low flexibility, moderate returns |

| 2. Public Provident Fund (PPF) | Government-backed Savings | Long-term savings scheme with tax benefits. | Safe, tax-free returns, flexible contributions | Long lock-in (15 years), moderate returns |

| 3. National Pension System (NPS) | Pension | Voluntary pension scheme with equity and debt options. | Market-linked returns, low cost, partial withdrawals | Market risk, complex to manage |

| 4. Employee Pension Scheme (EPS) | Pension | Part of EPF; offers monthly pension after retirement. | Guaranteed pension, employer contribution | Pension amount limited, no lump sum |

| 5. Atal Pension Yojana (APY) | Government Pension | Pension scheme for unorganized and salaried workers. | Guaranteed pension, government backed | Low contribution limit, limited payout |

| 6. Senior Citizens Savings Scheme (SCSS) | Post-retirement Savings | Government savings scheme for retirees. | High interest rate, regular income | Limited to post-retirement, lock-in period |

| 7. Fixed Deposits (FD) with Banks/Companies | Savings/Investment | Fixed interest returns on deposits. | Safe, guaranteed returns | Taxable interest, inflation risk |

| 8. Mutual Fund Retirement Plans | Market-linked Investment | Retirement-focused mutual funds with equity and debt mix. | Potential high returns, flexibility | Market risk, no guaranteed returns |

| 9. Life Insurance Retirement Plans | Insurance + Investment | Combines life cover and retirement savings. | Life cover, tax benefits | Lower returns, higher charges |

| 10. Voluntary Provident Fund (VPF) | Provident Fund | Voluntary contribution to EPF beyond mandatory limit. | Higher savings, tax benefits | Money locked until retirement |

5. FAQs on Retirement Benefits for Salaried Employees

Q1: When can I withdraw my EPF?

A: EPF can be withdrawn after retirement or after 2 months of unemployment.

Q2: Are retirement benefits taxable?

A: Depends on the plan and withdrawal conditions. Many have tax exemptions up to a limit.

Q3: Can I contribute voluntarily to EPF?

A: Yes, through Voluntary Provident Fund (VPF).

Q4: Is NPS a safe investment?

A: NPS is regulated and diversified but subject to market risk.

Q5: How is pension calculated under EPS?

A: Based on the pensionable salary and years of service.

Q6: Can I nominate my family for retirement benefits?

A: Yes, most plans allow nomination.

Q7: Can I invest in multiple retirement plans simultaneously?

A: Yes, it’s advisable to diversify.

Q8: What happens if I switch jobs?

A: You can transfer your EPF and pension accounts to the new employer.

Q9: Are employer contributions mandatory for EPF?

A: Yes, for organizations with 20+ employees.

Q10: How to ensure inflation protection in retirement corpus?

A: Invest in market-linked plans like NPS or mutual funds.