1. What is a Hybrid Mutual Fund?

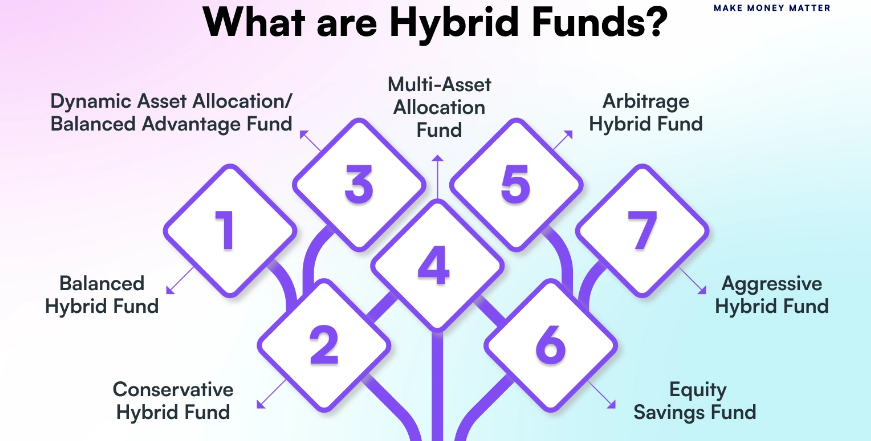

A Hybrid Mutual Fund is a type of investment fund that combines two or more asset classes, primarily equity (stocks) and debt (bonds or fixed income securities), within a single portfolio. The main goal of a hybrid fund is to balance the potential for growth from equities with the stability and regular income provided by debt instruments. This mix helps investors manage risk while aiming for reasonable returns.

Hybrid funds are ideal for investors who want diversification without having to invest separately in multiple types of funds. The proportion of equity and debt in these funds varies depending on the fund’s objective, risk profile, and market conditions. For example, aggressive hybrid funds have a higher equity exposure (typically 65-80%), while conservative hybrid funds may have a larger portion in debt (around 10-25%).

By investing in hybrid mutual funds, investors can enjoy both capital appreciation and income generation, making these funds suitable for those with moderate risk tolerance and medium to long-term investment horizons.

2. Benefits of Hybrid Mutual Funds

Here are the key benefits of Hybrid Mutual Funds:

- Diversification

Hybrid funds invest in a mix of equity (stocks), debt (bonds), and sometimes other assets. This diversification helps reduce risk compared to investing solely in equities. - Balanced Risk and Return

By combining equity and debt, hybrid funds aim to balance potential high returns from equities with the relative stability of debt instruments. - Convenience

Investors get exposure to multiple asset classes in a single fund, eliminating the need to manage separate equity and debt investments. - Professional Management

Fund managers actively manage the allocation between equity and debt based on market conditions, aiming to optimize returns. - Suitability for Moderate Risk Tolerance

Hybrid funds are ideal for investors who want moderate risk and moderate returns, rather than the high risk of pure equity or low returns of pure debt. - Reduced Volatility

Because of the debt component, hybrid funds typically experience less volatility than pure equity funds. - Flexibility

Some hybrid funds (like dynamic asset allocation funds) adjust the equity-debt mix dynamically based on market opportunities, potentially improving performance.

3. Risks of Hybrid Mutual Funds

| Risk | Explanation |

|---|---|

| Market Risk | Equity portion is subject to market volatility. |

| Interest Rate Risk | Debt portion’s value can decline if interest rates rise. |

| Credit Risk | Risk of default by debt issuers in the portfolio. |

| Allocation Risk | Poor allocation between equity and debt can impact returns. |

| Liquidity Risk | Some debt instruments may be less liquid. |

| Management Risk | Performance depends on the fund manager’s decisions. |

4. Top 10 Hybrid Mutual Fund Plans in India (as of recent data)

Here are some popular hybrid funds in India (performance and ranking may vary over time):

| Fund Name | Fund House | Type |

|---|---|---|

| HDFC Hybrid Equity Fund | HDFC AMC | Aggressive Hybrid |

| ICICI Prudential Equity & Debt Fund | ICICI Prudential | Aggressive Hybrid |

| SBI Equity Hybrid Fund | SBI Mutual Fund | Aggressive Hybrid |

| Mirae Asset Hybrid Equity Fund | Mirae Asset | Aggressive Hybrid |

| Kotak Equity Hybrid Fund | Kotak AMC | Aggressive Hybrid |

| Aditya Birla Balanced Advantage Fund | Aditya Birla AMC | Dynamic Asset Allocation |

| Nippon India Balanced Advantage Fund | Nippon India AMC | Dynamic Asset Allocation |

| Axis Balanced Advantage Fund | Axis AMC | Dynamic Asset Allocation |

| Franklin India Equity Hybrid Fund | Franklin Templeton | Aggressive Hybrid |

| UTI Equity Hybrid Fund | UTI Mutual Fund | Aggressive Hybrid |

5. Comparison of Top 10 Hybrid Funds (Pros & Cons)

| Fund Name | Pros | Cons |

|---|---|---|

| HDFC Hybrid Equity Fund | Strong track record, good equity-debt balance | Slightly higher expense ratio |

| ICICI Prudential Equity & Debt Fund | Good long-term returns, experienced management | Moderate risk due to equity exposure |

| SBI Equity Hybrid Fund | Affordable, consistent performance | Equity exposure leads to volatility |

| Mirae Asset Hybrid Equity Fund | High equity focus, good for growth | Higher risk due to aggressive allocation |

| Kotak Equity Hybrid Fund | Good blend of stability and growth | Slightly lower returns during equity bull runs |

| Aditya Birla Balanced Advantage Fund | Dynamic allocation adjusts to market conditions | Returns can be volatile depending on market timing |

| Nippon India Balanced Advantage Fund | Active asset allocation, good for moderate risk | Expense ratio slightly higher than peers |

| Axis Balanced Advantage Fund | Strong performance in recent years | Higher volatility during market downturns |

| Franklin India Equity Hybrid Fund | Experienced fund house, consistent dividends | Equity risk may impact returns in bearish markets |

| UTI Equity Hybrid Fund | Stable returns over long term | Less aggressive, may underperform in bull markets |

6. Frequently Asked Questions (FAQs) about Hybrid Mutual Funds

Q1. What are hybrid mutual funds?

Hybrid mutual funds invest in a mix of equity and debt instruments to balance risk and returns.

Q2. Who should invest in hybrid mutual funds?

They are suitable for investors with moderate risk tolerance seeking both growth and income.

Q3. How are hybrid mutual funds taxed?

Taxation depends on whether the fund is equity-oriented or debt-oriented and the holding period, with long-term and short-term capital gains taxed differently.

Q4. What is the typical asset allocation in hybrid funds?

Allocation varies; aggressive hybrids have higher equity (65-80%), conservative hybrids have lower equity (10-25%), and balanced advantage funds adjust dynamically.

Q5. Can I switch between hybrid and other mutual fund types?

Yes, most mutual funds allow switching, but charges or exit loads may apply.

Q6. Are hybrid funds less risky than pure equity funds?

Generally, yes, because the debt component helps reduce overall portfolio volatility.

Q7. Do hybrid mutual funds pay dividends?

Some hybrid funds offer dividend payout or reinvestment options, depending on the scheme.

Q8. What is the minimum investment amount in hybrid mutual funds?

Typically ranges from ₹500 to ₹5,000, depending on the fund.

Q9. How often can I redeem from hybrid mutual funds?

Most allow redemption anytime, though some may have exit loads if redeemed within a specified period.

Q10. What are balanced advantage funds?

Balanced advantage funds dynamically adjust their equity and debt allocation based on market conditions.