What is Public Provident Fund (PPF)?

The Public Provident Fund (PPF) is a long-term savings scheme established by the Government of India to encourage individuals to save money with attractive interest rates and tax benefits. It has a lock-in period of 15 years and offers a safe and secure investment avenue backed by the government.

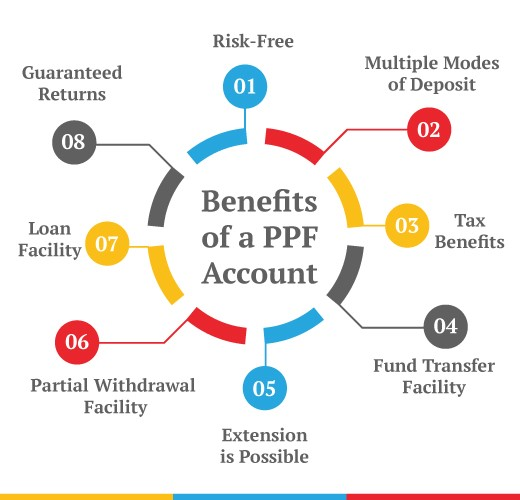

Benefits of Public Provident Fund (PPF)

- Tax Benefits: Contributions up to ₹1.5 lakh per annum qualify for deduction under Section 80C of the Income Tax Act.

- Attractive Interest Rates: The interest rate is set by the government every quarter and is generally higher than fixed deposits.

- Safety: Being a government-backed scheme, it carries virtually no risk of default.

- Compound Interest: Interest is compounded annually, enhancing wealth growth over time.

- Loan and Withdrawal Facility: Partial withdrawals and loans against the balance are allowed after certain years.

- Long-Term Investment: Helps in building a retirement corpus or funding long-term goals.

- Exempt-Exempt-Exempt (EEE) Status: Contributions, interest earned, and maturity amount are tax-free.

Risks of Public Provident Fund (PPF)

- Lock-in Period: The 15-year lock-in period limits liquidity and flexibility.

- Interest Rate Fluctuations: The interest rate is subject to government revisions quarterly, which can reduce returns.

- Limited Investment Amount: Maximum annual contribution is ₹1.5 lakh.

- Inflation Risk: Returns may not always keep pace with inflation, reducing real purchasing power.

- Premature Closure: Allowed only under specific conditions (e.g., medical emergencies, after 5 years) with penalties.

Top 10 PPF Account Providers in India

Actually, PPF is a government scheme, and accounts can be opened only with authorized banks or post offices. The “plans” are essentially the same PPF scheme, but accounts can be opened at different institutions. Here are the top 10 banks/post offices offering PPF accounts:

| Institution | Pros | Cons |

|---|---|---|

| 1. Post Office | Widely accessible, traditional | Slower processing, less digital |

| 2. SBI | Easy online access, wide branch network | Slightly lower interest processing speed |

| 3. HDFC Bank | Digital services, customer support | Limited branches in some areas |

| 4. ICICI Bank | Online account management | Service charges for certain requests |

| 5. Axis Bank | Digital facilities | Limited branch presence in rural areas |

| 6. Punjab National Bank | Strong government linkage | Branch access may vary |

| 7. Bank of Baroda | Good branch network | Slower online services compared to private banks |

| 8. Canara Bank | Reliable service | Moderate digital features |

| 9. Kotak Mahindra Bank | Advanced digital interface | Higher minimum balance in some cases |

| 10. Union Bank of India | Good customer service | Limited digital features compared to private banks |

Comparison Table of PPF Account Providers

| Provider | Interest Crediting Speed | Online Access | Branch Network | Customer Service | Fees/Charges | Suitability |

|---|---|---|---|---|---|---|

| Post Office | Moderate | Limited | Very Wide | Moderate | Nil | Rural, traditional users |

| SBI | Fast | Excellent | Very Wide | Good | Nil | All-rounder, nationwide |

| HDFC Bank | Fast | Excellent | Moderate | Very Good | Possible fees | Tech-savvy, urban users |

| ICICI Bank | Fast | Excellent | Moderate | Good | Some service fees | Digital-friendly users |

| Axis Bank | Fast | Very Good | Moderate | Good | Minimal fees | Urban and semi-urban customers |

| Punjab National Bank | Moderate | Moderate | Wide | Moderate | Nil | Government scheme loyalists |

| Bank of Baroda | Moderate | Moderate | Wide | Moderate | Nil | Traditional users |

| Canara Bank | Moderate | Moderate | Wide | Good | Nil | Balanced choice |

| Kotak Mahindra Bank | Fast | Excellent | Limited | Very Good | Possible fees | Tech-savvy, premium customers |

| Union Bank of India | Moderate | Moderate | Wide | Good | Nil | General users |

FAQs for Public Provident Fund (PPF)

- Who can open a PPF account?

Any Indian citizen can open a PPF account. A minor’s account can be opened by a guardian. - What is the minimum and maximum investment?

Minimum ₹500 per year and maximum ₹1.5 lakh per year. - Can NRIs open or continue PPF accounts?

NRIs cannot open a new account, but existing accounts can be continued until maturity. - What is the tenure of a PPF account?

The tenure is 15 years, extendable in blocks of 5 years. - Is the interest earned taxable?

No, interest earned is completely tax-free. - Can I withdraw money from PPF before maturity?

Partial withdrawals are allowed from the 7th year onwards under certain conditions. - Is loan against PPF available?

Yes, loans can be taken from the 3rd to 6th year of the account. - What happens if I miss contributions?

You can make a minimum contribution of ₹500 per year to keep the account active, else a penalty applies. - Can PPF accounts be transferred?

Yes, PPF accounts can be transferred between banks/post offices. - Is PPF a safe investment?

Yes, since it is backed by the Government of India.